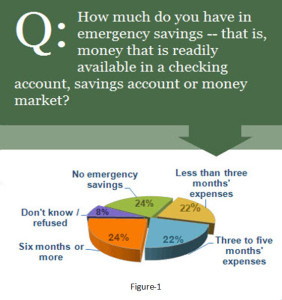

If you are, you’re not alone. The Wall Street Journal recently reported that regardless of income, 70% of Americans are living from paycheck to paycheck. As a result, seventy-six percent of Americans have less than six months’ living expenses in emergency savings.

If you are, you’re not alone. The Wall Street Journal recently reported that regardless of income, 70% of Americans are living from paycheck to paycheck. As a result, seventy-six percent of Americans have less than six months’ living expenses in emergency savings.

Without an emergency reserve, if a sudden disruption in household income were to occur, anybody is 30 to 60 days away from a late payment being reported on their credit report, and 90 to 120 days away from a Notice of Default and foreclosure, which will negatively impact both their credit score and credit history. How would missing even one paycheck affect your household finances?

The most common reason people give for the circumstances listed above is they don’t make enough money. While in some instances that may very well be true, we believe there is a much more likely explanation: Parkinson’s Law.

The most common reason people give for the circumstances listed above is they don’t make enough money. While in some instances that may very well be true, we believe there is a much more likely explanation: Parkinson’s Law.

Parkinson’s Law is one of the least known, and most important, laws of money and wealth accumulation. It was developed by English writer C. Northcote Parkinson many years ago and it explains why most people retire poor. Parkinson’s Law states, among other things, that “Expenses rise to equal income.”

It says that no matter how much money people earn, they tend to spend the entire amount, and a little bit more besides. Their expenses rise in lockstep with their earnings. Many people are earning today several times what they were earning at their first jobs, but, somehow, they seem to need every single penny to maintain their current lifestyles. No matter how much they make, there never seems to be enough.

I have clients that make $50,000 per year that tell me if they just made $75,000 per year they’d have it made. I have clients that make $75,000 per year that tell me if they just made $100,000 per year they’d have it made. I also have clients that make $225,000 per year that tell me if they just made $250,000 per year they’d have it made.

All of these people share a common belief that their problem is a lack of income. While making more money can certainly mitigate some issues, Parkinson’s Law says that when a raise in pay does come along it is quickly consumed by an increase in lifestyle, such as a newer or nicer car, a newer or nicer house, a remodel of an existing house, an upgrade in furnishings, new desert toys, watercraft, an exotic family vacation, etc… And shouldn’t you be able to enjoy these things? After all, you work hard and earn your income and you deserve to enjoy the fruits of that labor, right? This is how Parkinson’s Law works.

All of these people share a common belief that their problem is a lack of income. While making more money can certainly mitigate some issues, Parkinson’s Law says that when a raise in pay does come along it is quickly consumed by an increase in lifestyle, such as a newer or nicer car, a newer or nicer house, a remodel of an existing house, an upgrade in furnishings, new desert toys, watercraft, an exotic family vacation, etc… And shouldn’t you be able to enjoy these things? After all, you work hard and earn your income and you deserve to enjoy the fruits of that labor, right? This is how Parkinson’s Law works.

Throughout our income earning years a significant amount of money will pass through our respective hands. During that time we will transfer a lot of those hard earned dollars to others, such as the IRS, banks, credit card companies, mortgage companies, etc… I refer to these as wealth transfers. We are transferring our wealth to others in exchange for something we want or need. Some wealth transfers can be eliminated, while others can only be minimized.

While we may not be able to do anything about the role Parkinson’s Law plays in your life, we may be able to help you increase your monthly cash flow by reducing or eliminating the unnecessary wealth transfers in your financial profile.

We find that people tend to lose money in the following areas:

- How they choose to structure and pay for their mortgage

- How they choose to pay their taxes

- How they choose to save for retirement

- How they choose to save for higher education

- How they choose to pay for their major capital purchases

The greatest impact you can have on your monthly cash flow is to identify any wealth transfers you may be making unknowingly and unnecessarily and take steps to minimize or eliminate them. We routinely improve our client’s monthly cash flow by hundreds, and sometimes even thousands, of dollars per month by finding the not-so-obvious transfers and doing just that, minimize or eliminate them.

If you would like us to help you identify the unnecessary wealth transfers that exist in your profile and devise a strategy and tactics to bring those dollars back under your control contact us to schedule a time to discuss your specific circumstances.

Leave a Comment