It’s true. Everything you buy is 100% financed! You may be thinking if you paid cash you didn’t finance anything. Consider this: If you borrow money, a lender finances your purchase, and you pay interest to the lender for the use of their money. However, if you pay cash, YOU finance your purchase. You self-finance. You save interest that would have been paid to the lender, but you lose interest that your cash would have earned had you invested it elsewhere.

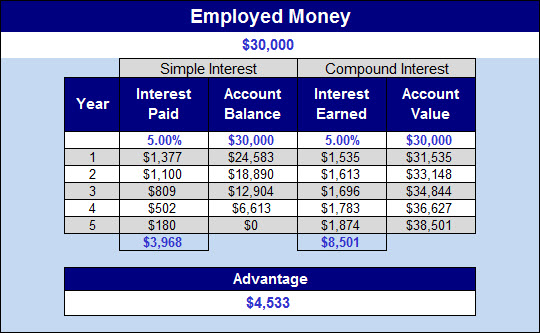

In a post entitled “Not All Debt Is Created Equal!” I gave an example of using personal debt to purchase a $30,000 car. Revisiting that example, let’s say you want to buy a $30,000 car and you decide to finance the purchase with a lender. The financing terms being offered by the lender are no money down at 5.00% for 5 years. If you borrow $30,000 at 5.00% for 5 years, your monthly principal and interest payment is $566.14. At the end of 5 years you will have paid the lender $33,968 ($566.14 x 60). That is the original $30,000 you borrowed plus $3,968 in interest over that 5 years.

In a post entitled “Not All Debt Is Created Equal!” I gave an example of using personal debt to purchase a $30,000 car. Revisiting that example, let’s say you want to buy a $30,000 car and you decide to finance the purchase with a lender. The financing terms being offered by the lender are no money down at 5.00% for 5 years. If you borrow $30,000 at 5.00% for 5 years, your monthly principal and interest payment is $566.14. At the end of 5 years you will have paid the lender $33,968 ($566.14 x 60). That is the original $30,000 you borrowed plus $3,968 in interest over that 5 years.

This is typically how a person calculates the cost of a purchase and is usually the basis for the decision to pay cash or finance. They reason that if they pay cash they can avoid paying all that interest to the lender, as well as avoid the monthly loan payments. While the interest in this scenario may represent how much you would pay to the lender for the use of their money over the loan term, it does not represent the true cost of the purchase.

Now let’s consider what it means to pay cash (self-finance). If you choose to pay cash for the $30,000 car, you more than likely believe the cost is $30,000. You are not alone in this belief. This belief stems from the fact that because you are paying cash you aren’t going to pay any interest. However, that belief ignores the fact that you will no longer be earning interest on that $30,000.

Let’s assume that if you left the $30,000 invested you could earn a rate of return of 5.00% over that five year period. At the end of 5 years your account value would grow to $38,501. The $8,501 ($38,501 – $30,000) is the interest your money would have earned. This is called opportunity cost. So, in this example, the cost of the car is really $38,501, even though you paid $30,000 cash, because you gave up the opportunity to earn $8,501 in interest. The graphic that follows is what it looks like.

Your goal of not paying interest of $3,968 has cost you the ability to earn interest of $8,501 on your money, which represents a loss to you of $4,533. Where did that money go? The bank got to keep that money. As the saying goes, the battle to not pay interest is won, but the wealth accumulation war is lost.

Your goal of not paying interest of $3,968 has cost you the ability to earn interest of $8,501 on your money, which represents a loss to you of $4,533. Where did that money go? The bank got to keep that money. As the saying goes, the battle to not pay interest is won, but the wealth accumulation war is lost.

This example gets far more interesting and favorable when you consider that a large majority of auto loans are available today with 0%, 1.9%, or 2.9% financing terms. If you were able to purchase the car utilizing 0% financing you could earn and keep the entire $8,501.

Why is the interest you pay ($3,968) to the lender for the use of their money less than the interest you earned ($8,501) if the interest rate in both scenarios is the same? Because money you invest has the opportunity to earn compound interest, while the interest you pay on money you borrow is repaid as simple interest.

In an amortizing loan, such as an auto loan, which is a simple interest loan, you are paying interest on the outstanding balance each month. That loan balance is decreasing with each payment and so is the portion of the monthly payment that is attributed to interest. When you invest money, the interest you earn is typically being reinvested in that account and that allows the interest to earn interest as well.

This is not to be interpreted to mean you can or should borrow your way to wealth. It is simply to point out that not all borrowing or debt is bad, as several financial entertainers in the media today would have you believe. It’s how you use debt that can make the difference.

If you’re interested in learning more about what to consider when determining which form of financing is best for a major capital purchase download our FREE report entitled “Is Paying Cash Detrimental to Your Financial Health?” We also encourage you to contact us to schedule a time to talk about your specific circumstances.

Leave a Comment