Throughout our income earning years a significant amount of money will pass through our respective hands. During that time we will transfer a lot of those hard earned dollars to others, such as the IRS, banks, credit card companies, mortgage companies, etc… Some intentionally and some unintentionally. Some of those transfers can be eliminated, while others can only be minimized.

Throughout our income earning years a significant amount of money will pass through our respective hands. During that time we will transfer a lot of those hard earned dollars to others, such as the IRS, banks, credit card companies, mortgage companies, etc… Some intentionally and some unintentionally. Some of those transfers can be eliminated, while others can only be minimized.

One area where we will transfer a substantial amount of money is how we choose to pay for our major capital purchases. What is a major capital purchase you ask? It is anything that you need to buy or want to buy in your current lifestyle that you cannot afford to pay for in full with your monthly cash flow. These include, but are not limited to, automobiles, houses, higher education, weddings, vacations, etc…

In a post entitled “Did You Know You Finance Everything You Buy?” I gave an example of the difference between paying cash for a car versus financing that purchase with a lender. In that example I showed that while paying cash for a $30,000 car would save the car buyer $3,968 in interest he might have otherwise paid a lender, he gave up the opportunity to earn $8,501 in interest he might have earned on that money had he left that money invested.

While it’s unlikely that any one car purchase will affect your financial profile in any significant way, over an estimated 50 car buying years of the average person, a lot of money, whether interest paid to a lender or interest not earned by a cash buyer, will flow through those car purchases.

Compound interest has long been called the eighth wonder of the world. It has risen to such heights because the exponential curve it creates rises to heights that command our attention. It doesn’t matter whether you save a single sum or a series of amounts; when left alone to grow, it grows exponentially. Then, not only do your deposits earn interest, but the interest earns interest as well. The potential is unlimited.

But, if the miracle of compound interest is really true, why aren’t we all rich by now? The answer is because we are interrupting compounding every time we empty our account to pay cash for a major capital purchase.

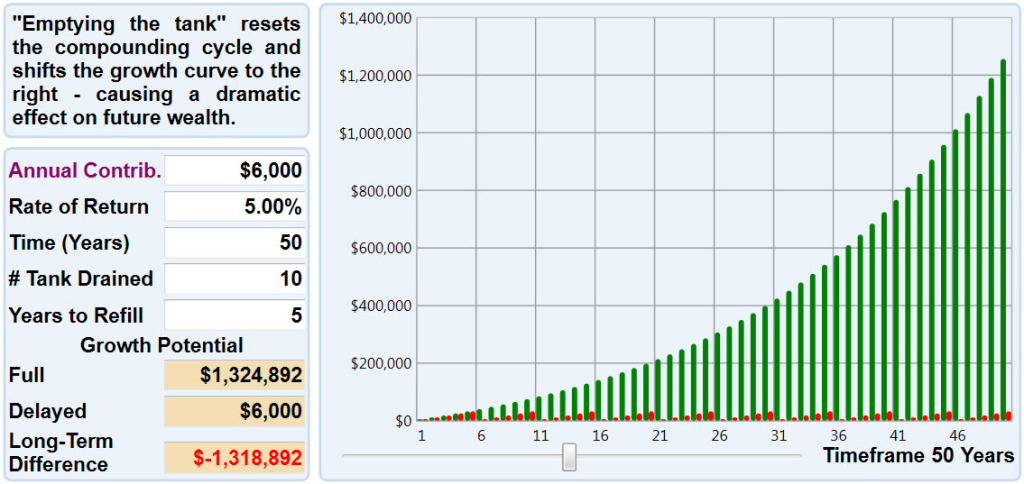

Let’s consider Joe, who makes an annual contribution of $6,000 per year to a savings account and he is earning a 5.00% return on his money over a 50 year window of time. Let’s assume Joe will purchase a car every 5 years over the next 50 years. If he pays cash for each car purchase, Joe is going to empty his savings account 10 times over his lifetime to pay for 10 cars. It will take him 5 years to refill the savings account each time it is emptied. Here’s the picture: save, empty, save, empty, save, empty, etc…

Joe is looking at the cost of the car as just what he paid in cash, but the true cost has to calculate what those dollars could have earned for him had he been able to keep the money invested. If that $6,000 per year was able to compound uninterrupted at 5.00% for the entire 50 year period it would grow to $1,324,892. Instead, by resetting compounding each time the account was emptied, the contributions were only able to grow to $6,000. That’s a loss of $1,318,892.

The green lines on the chart above show what Joe’s savings account may grow to if allowed to compound uninterrupted over 50 years. The red lines show what Joe’s account might look like if it were to grow and be emptied every 5 years to pay cash for a car.

The green lines on the chart above show what Joe’s savings account may grow to if allowed to compound uninterrupted over 50 years. The red lines show what Joe’s account might look like if it were to grow and be emptied every 5 years to pay cash for a car.

Suppose you were going to enter a 10k run. You get your number and line up at the starting line and when you hear the starter pistol you start running along with all the other runners. While you may not be in the lead, you’re doing pretty well compared to the rest of the runners. About 2 miles into the run you begin to get thirsty. As you plod along you remember that there were bottles of water on the table at the starting line. So you run back to the start and get a drink and then return to the run. What are the chances you will ever catch up to where you were?

Have you been resetting compounding? Give us a call and learn how you can avoid this crippling financial decision.

If you’re interested in learning more about what to consider when determining which form of financing is best for a major capital purchase download our FREE report entitled “Is Paying Cash Detrimental to Your Financial Health?” We also encourage you to contact us to schedule a time to talk about your specific circumstances.

Leave a Comment