In a March 26, 2015 article entitled “Stress in America Caused by Money,” money topped the list of stressors to Americans, beating out work, family responsibilities, and health concerns. Many Americans have taken steps to cut back on their expenses, including using coupons, cooking more at home, and cutting back on non-essentials in an attempt to alleviate the stress. However, despite these steps, 54 percent of Americans say they have “just enough” or “not enough” money to make ends meet at the end of the month.

In a March 26, 2015 article entitled “Stress in America Caused by Money,” money topped the list of stressors to Americans, beating out work, family responsibilities, and health concerns. Many Americans have taken steps to cut back on their expenses, including using coupons, cooking more at home, and cutting back on non-essentials in an attempt to alleviate the stress. However, despite these steps, 54 percent of Americans say they have “just enough” or “not enough” money to make ends meet at the end of the month.

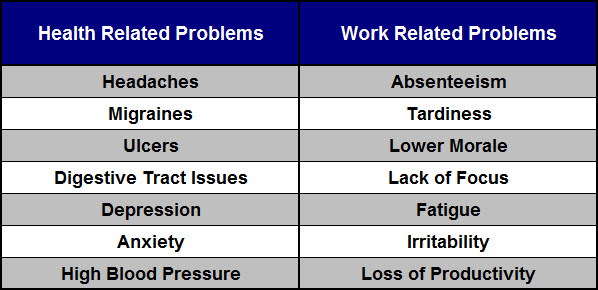

The stress that results from such financial concerns often leads to health problems as well as problems at work, which only serve to compound the stress further. Several studies show that financial stress is linked to the following:

Fighting about money is also a leading cause for divorce. To be fair, it’s not usually the lack of finances that causes the divorce, but the lack of compatibility in the financial area. Opposites can attract, but when two people are opposites in the financial department, divorce is often the result. Imagine the conflict if one spouse is a saver and one spouse is a spender. One is focused on the future, while the other believes in living for today. One has a problem buying on credit, while the other believes in saving up for what one wants. Over time, this conflict can reach such heights that divorce seems to be the only logical conclusion.

Many Americans share a common belief that their problem is a lack of income. While making more money can certainly mitigate some issues, many of us are limited in what we can do to increase our income. However, there is potentially much we can do to become more efficient with our personal finances.

I’m not talking about cutting back on Starbucks or getting rid of cable TV or anything of that nature. I’m talking about becoming more efficient with the money you already spend. Have you ever considered that improving your cash flow by becoming more efficient in your finances has the same impact on your household budget as a raise in pay? In fact, as a result of the taxes taken out of your paycheck, the raise in pay is not as beneficial as becoming more efficient.

I’m not talking about cutting back on Starbucks or getting rid of cable TV or anything of that nature. I’m talking about becoming more efficient with the money you already spend. Have you ever considered that improving your cash flow by becoming more efficient in your finances has the same impact on your household budget as a raise in pay? In fact, as a result of the taxes taken out of your paycheck, the raise in pay is not as beneficial as becoming more efficient.

A savings of $250 per month as a result of becoming more financially efficient is roughly equivalent to a $357 ($250 ÷ 0.70) monthly increase in pay at your job. Your employer will typically withhold about 30% of your gross earnings to cover your tax liability, which will net you about $250 ($357 – (30% of $357)).

Research has shown that people who take an active role in planning and learning about their finances were less stressed and more confident in their financial situations. We help our clients identify any financial inefficiencies that exist in their profile and show them how to reduce or eliminate them.

We find that people tend to lose money in the following areas:

- How they choose to structure and pay for their mortgage

- How they choose to pay their taxes

- How they choose to save for retirement

- How they choose to save for higher education

- How they choose to pay for their major capital purchases

The greatest impact you can have on your monthly cash flow is to identify any financial inefficiencies that may exist in your financial profile and take steps to minimize or eliminate them. We routinely improve our client’s monthly cash flow by hundreds, and sometimes even thousands, of dollars per month by finding the not-so-obvious transfers and doing just that, minimize or eliminate them.

If you would like us to help you identify the financial inefficiencies that exist in your profile and devise a strategy and tactics to bring those dollars back under your control contact us to schedule a time to discuss your specific circumstances.

Leave a Comment