Mortgage insurance is often seen as or referred to as a necessary evil. It’s a lot like life insurance, or any type of insurance for that matter, in that nobody likes paying the premiums, but they sure like it when they need to make a claim.

Mortgage insurance is often seen as or referred to as a necessary evil. It’s a lot like life insurance, or any type of insurance for that matter, in that nobody likes paying the premiums, but they sure like it when they need to make a claim.

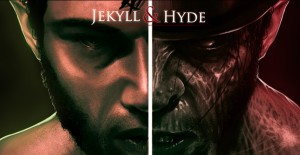

When I’m asked to explain mortgage insurance I usually begin by comparing mortgage insurance to Dr. Jekyll and Mr. Hyde. Like Dr. Jekyll and Mr. Hyde, mortgage insurance has a good side and a bad side. Unfortunately, it’s the bad side the gets all the publicity.

Let’s begin by taking a look at mortgage insurance from the viewpoint of Dr. Jekyll.

Mortgage insurance plays a vital role in the path to home ownership. While you will never be able to make a claim, mortgage insurance makes it possible for aspiring homeowners to purchase a house with less than a 20% down payment. In the absence of mortgage insurance a homebuyer would need a 20% down payment. How long would it take you to save for a 20% down payment?

Let’s assume you want to purchase a house for $300,000. Let’s also assume that you are adamantly opposed to paying mortgage insurance premiums and you committed to saving enough money to provide a 20% down payment. If you could save $500 per month in an account earning a 5% rate of return, it would take 98 months, or 8 years and 2 months, to accumulate $60,000.

Let’s assume you want to purchase a house for $300,000. Let’s also assume that you are adamantly opposed to paying mortgage insurance premiums and you committed to saving enough money to provide a 20% down payment. If you could save $500 per month in an account earning a 5% rate of return, it would take 98 months, or 8 years and 2 months, to accumulate $60,000.

What happened to the value of that house during those 8 years? Assuming a conservative 2.5% annual rate of appreciation, in 8 years that house would cost $365,000. While you were saving $60,000, the house increased in cost by $65,000. If you had purchased the house 8 years earlier utilizing minimum down payment financing, the house would still be worth $365,000 and that $65,000 of equity would be yours.

Now the 20% down payment will be $73,000 ($365,000 x 20%) instead of the $60,000 you had planned for. This brings up two questions:

- How much longer will it take to save the additional $13,000 ($73,000 – $60,000)?

- How much more will the house cost at the end of that additional time?

This example demonstrates that there is a cost to saving to buy a house. And sometimes that cost can be significant. Mortgage insurance helps aspiring homeowners buy a home sooner and with less money toward the down payment. It also demonstrates that mortgage insurance acts as an inflation hedge by allowing you to lock in what you pay for the house based on today’s value instead of what that house may be worth in 8 or more years. In a previous post I demonstrated how real estate and mortgage loans act as inflation hedges.

The lack of a 20% down payment isn’t the only reason an aspiring homeowner might secure a mortgage loan that requires mortgage insurance. What if the money you planned to use for a down payment was earning a significant return from whatever the money is invested in and you didn’t want to sacrifice that return to provide a 20% down payment? What if you wanted to maximize the favorable tax treatment of mortgage interest by securing a larger mortgage amount and providing less than a 20% down payment? Mortgage insurance may allow you to accomplish one or both of those worthwhile objectives.

Now, let’s take a look at mortgage insurance from the viewpoint of Mr. Hyde.

Until 2007, mortgage insurance premiums were not tax-deductible on your income tax return. However, as a result of the Tax Relief and Health Care Act of 2006, for tax years 2007 through 2014, homeowners were able to deduct as an itemized deduction the cost of premiums for qualified mortgage insurance on a qualified home. The reason this is listed in Mr. Hyde’s viewpoint is because I believe that Congress will allow this measure to expire and, as a result, mortgage insurance will revert back to being non-tax-deductible. If that happens, mortgage insurance will still serve a vital purpose in the path to homeownership, but it will no longer receive favorable tax treatment.

If you do obtain a mortgage loan and mortgage insurance is required, the mortgage insurance premium(s) will increase your monthly payment and increase your overall cost of homeownership. For example, if you pay $250 per month in mortgage insurance premiums for 10 years (120 months), at the end of 10 years you will have paid $30,000 ($250 x 120) in mortgage insurance. A mortgage loan that doesn’t require mortgage insurance will save you that $30,000, but you may not have the 20% down payment needed to eliminate it.

Because the risk of loss to a lender diminishes as a borrower’s equity stake grows beyond the 20 percent level, large investors like Fannie Mae and Freddie Mac permit cancellation of mortgage insurance coverage under certain circumstances. The reason this is listed in Mr. Hyde’s viewpoint is because while mortgage insurance can be cancelled, it’s not a particularly easy process to cancel it. In fact, many homeowners will have an easier time refinancing to eliminate it.

Because the risk of loss to a lender diminishes as a borrower’s equity stake grows beyond the 20 percent level, large investors like Fannie Mae and Freddie Mac permit cancellation of mortgage insurance coverage under certain circumstances. The reason this is listed in Mr. Hyde’s viewpoint is because while mortgage insurance can be cancelled, it’s not a particularly easy process to cancel it. In fact, many homeowners will have an easier time refinancing to eliminate it.

Mortgage insurance makes homeownership possible for millions of Americans that would otherwise not be able to purchase a home of their own. So I ask you, is mortgage insurance Dr. Jekyll or Mr. Hyde?

In my opinion, the only truly bad thing about mortgage insurance is paying the monthly premium one month longer than is absolutely necessary. If you would like to find out what options are available to you to eliminate monthly mortgage insurance premiums please contact us to schedule a time to talk about your specific circumstances.

Leave a Comment