Is your wealth in the house (equity) safe? Is it at risk? To answer that question you must first understand what we mean by safe. Let’s define safety as minimizing or eliminating the potential loss of the investment. Will Rogers once said, “Return ‘of’ my money is more important than return ‘on’ my money.”

Your wealth in the house is constantly changing in accordance with the amount of principal you pay monthly against your outstanding mortgage balance and fluctuations in the value of the house. If you don’t want to lose the money you invest in the house, it is helpful to understand the key risks to parking your wealth in the house.

There are four primary risks that could become threats to the wealth in your house: 1) Appreciation, 2) Depreciation, 3) Foreclosure, and 4) Lawsuit.

There are four primary risks that could become threats to the wealth in your house: 1) Appreciation, 2) Depreciation, 3) Foreclosure, and 4) Lawsuit.

The first key threat to wealth in the house could come through market appreciation. How can appreciation be a “threat?” Rapid appreciation often results in higher property taxes and higher insurance premiums. Many retired people living on fixed incomes end up selling their houses because they feel overwhelmed by fast-rising property taxes. We are protected from this in a big way in California through Proposition 13, which was passed back in 1978.

While the issue of rising property taxes and homeowners insurance premiums is a concern, the bigger issue is that more of your wealth is parked in the house. That may or may not be a good thing.

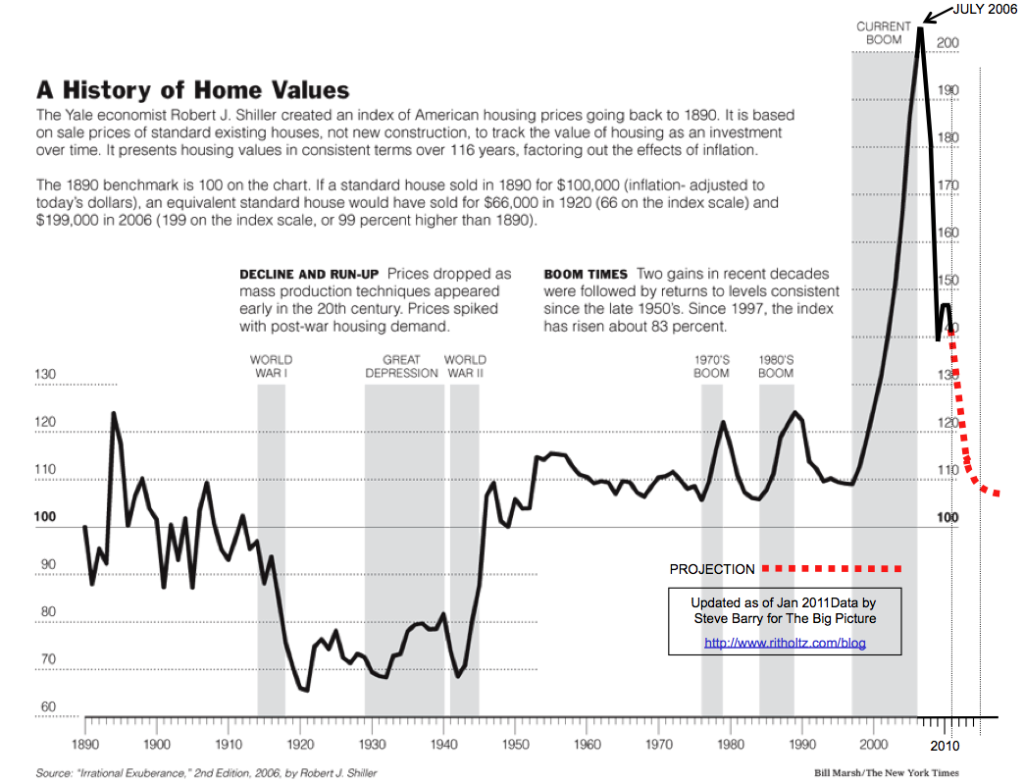

The second key threat to wealth in the house could come through market depreciation. If your local housing market were to dip, as we have seen nationwide since 2008, the wealth in your house could drop quickly and dramatically.

The overriding issue with depreciation is the “feeling of loss” that a homeowner experiences when the market value of their house drops. Actual loss occurs only when a homeowner must sell their house during a market downturn. To reduce the threat of depreciation to wealth in the house, you need to be able to control the timing of the sale. The key to avoiding the loss of wealth in the house in a depreciating market is having the flexibility to wait for the market to recover. Historically, the demand for housing has always led to a market recovery, usually taking anywhere from three to ten years, depending on the amount of the depreciation, the size of the market, and other factors.

The overriding issue with depreciation is the “feeling of loss” that a homeowner experiences when the market value of their house drops. Actual loss occurs only when a homeowner must sell their house during a market downturn. To reduce the threat of depreciation to wealth in the house, you need to be able to control the timing of the sale. The key to avoiding the loss of wealth in the house in a depreciating market is having the flexibility to wait for the market to recover. Historically, the demand for housing has always led to a market recovery, usually taking anywhere from three to ten years, depending on the amount of the depreciation, the size of the market, and other factors.

The third key threat to wealth in the house is foreclosure. If you cannot make your mortgage payments and a lender forecloses, you lose control of the house. You also lose control of the wealth in the house, assuming there is any. The lender will sell the house to recover what’s owed to them. Your wealth in your house is not guaranteed. If you were unable to make the payments, the bank could exercise its contractual right to take possession of the house through the process of foreclosure.

No one who invests money in a house plans to go into foreclosure, yet foreclosure is fairly common, unfortunately. The threat of foreclosure remains until you pay the entire mortgage balance. Regardless of your existing circumstances, your next month’s mortgage payment is due in full on the first of the month. Additional wealth invested in the house provides additional security to the lender, not the borrower.

The majority of events that lead to foreclosure are largely beyond our control. These include, but are not limited to, disability, loss of employment, divorce, and death. Think about the odds of an unforeseen occurrence that could lead to a major financial hardship in your life. If you suddenly experienced difficult financial times, would you rather have $25,000 of cash in the bank to help you make your mortgage payments, or an additional $25,000 of wealth in your house?

A fourth key threat to wealth in the house could come from a lawsuit or related legal threat, such as bankruptcy. Some states have homestead exemption laws which provide varying degrees of protection of wealth in the house from most lawsuits and bankruptcy acts. However, you should confirm for yourself if your state has homestead exemption laws and to what degree those laws protect you and your wealth in the house.

The best deterrent would be to have no wealth inside the house, eliminating the house as a potential asset for lawsuit. To do this, the wealth inside the house would need to be repositioned to specific products that are secure from creditors and predators. This must be done before any known action or pending threat of litigation has occurred.

The best deterrent would be to have no wealth inside the house, eliminating the house as a potential asset for lawsuit. To do this, the wealth inside the house would need to be repositioned to specific products that are secure from creditors and predators. This must be done before any known action or pending threat of litigation has occurred.

So, I’ll ask the question again; Is the wealth in your house (equity) safe? We believe the answer is a resounding NO! The wealth in your house is no safer than any other investment whose value is determined by an external market over which we personally have no control.

In the next post in this series we will ponder the question “Is Your Wealth in the House (Equity) Liquid?”

If you’re interested in learning more about the house as an investment and how owning a house can help you grow your wealth contact us to schedule a time to talk about your specific circumstances.

Leave a Comment