The financial media and traditional financial advisors have us trained to make decisions based on numbers on a piece of paper. However, in my experience, money isn’t math and math isn’t money. Placing too much importance on numbers and allowing them to dictate our financial decisions is very similar to confusing the differences between price and cost. Statistics can be presented in any way and given any context in order to convince people of just about anything. But statistics are a trivial part of reality at best, and, more often than not, are considerably misleading.

For example, let’s say that I proposed an investment opportunity for your consideration. The investment has an average rate of return of 25%. Would you be interested? Of course you would. Who wouldn’t?

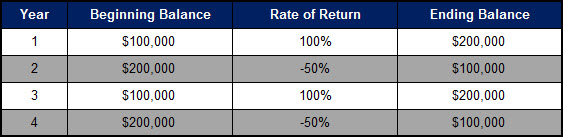

Let’s say you invested $100,000 and in year one the investment returned 100% on your money. At the end of year one you would have $200,000. In year two the investment lost 50%. At the end of year two you would have $100,000. In year three the investment returned 100% again. At the end of year three you would have $200,000. In year four the investment lost 50% again. At the end of year four you would have $100,000.

The math tells us that the average rate of return is 25% (100% – 50% + 100% – 50% = 100% ÷ 4 = 25%) over the four year period. However, the money tells us that the rate of return over the 4 years is 0%. You invested $100,000 and at the end of four years you had $100,000. This is a great example of how money isn’t math and math isn’t money.

More often than not, whoever has the guts to show the highest returns on an illustration gets the business. In the context of traditional financial planning especially, numbers have been used to provide more misinformation than accuracy; they are used to match what an advisor thinks he can sell to the client. There are many things to consider before you decide where to invest your money and rate of return is only one consideration.

If you’re interested in learning more about what to consider when you invest your money please contact us and schedule a time to talk.

Leave a Comment