When an aspiring homeowner applies for a mortgage to finance the purchase of a home of their own they are confronted with a great many decisions. Decisions they may not be equipped to answer without professional guidance. One of those decisions is whether or not to pay loan discount points to secure a lower interest rate on a mortgage loan.

When an aspiring homeowner applies for a mortgage to finance the purchase of a home of their own they are confronted with a great many decisions. Decisions they may not be equipped to answer without professional guidance. One of those decisions is whether or not to pay loan discount points to secure a lower interest rate on a mortgage loan.

So, how do you determine if you should pay points or not? I encourage you to read to the end because it’s not how you think.

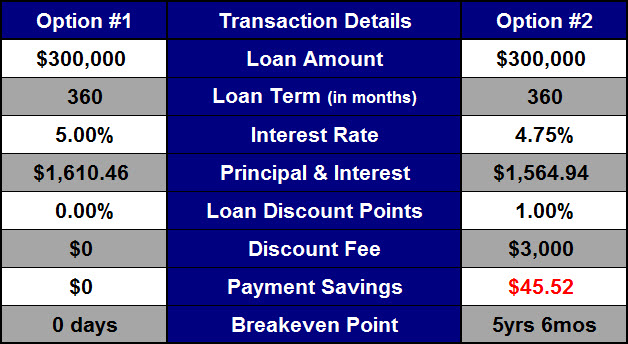

Let’s compare two typical options to understand the economics. Option #1 is obtaining a $300,000 30-year fixed rate mortgage at 5.0% with zero points ($0). The monthly principal & interest payment is $1,610.46. Option #2 is obtaining a $300,000 30-year fixed rate mortgage at 4.75% with one loan discount point ($3,000). The monthly principal & interest payment is $1.564.94.

The difference in monthly payment is $45.52 ($1,610.46 – $1,564.94). The cost to obtain the lower payment is one point, or 1.0% of the loan amount, which is $3,000 ($300,000 x 1.0%). So your choice is to pay $3,000 up front and keep $45.52 more per month in your pocket, or keep your $3,000 today and give the lender $45.52 more per month every month you have that mortgage. If you choose to pay the discount point, the breakeven point appears to be 65.9 months, or 5 years 6 months ($3,000 ÷ $45.52).

This is how most loan officers calculate and explain it, and if you took the time to calculate the cost of the lower mortgage payment yourself, this is likely how you determined whether it made financial sense. You reason that you’ll be in the house longer than 5 ½ years, so you determine that it’s worth it and you pay the point. However, that can be a big mistake. Worse yet, it’s the kind of mistake that goes unnoticed. This simple calculation is flawed. This is definitely one example where simplicity can cost you.

If you’ve even considered paying the $3,000 loan discount point, then it is necessary to consider what other options you have with that money and the resulting financial impact of those options. This comes down to determining the highest and best use of your money. You could pay the point, invest the money, pay down or payoff another debt, or increase your down payment.

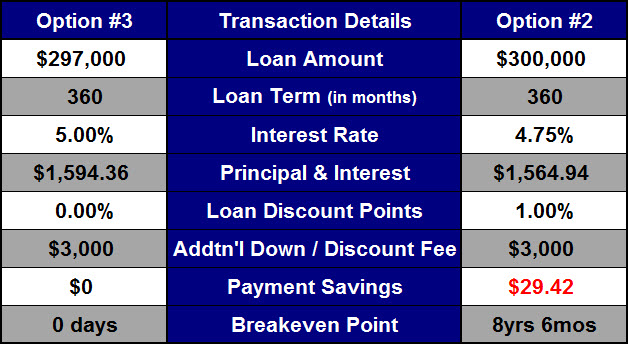

Let’s compare paying one point to increasing your down payment. Option #3 is to increase your down payment by $3,000 and obtain a $297,000 30-year fixed rate mortgage at 5.0% with zero points ($0). The monthly principal & interest payment is $1,594.36. Option #2 is obtaining a $300,000 30-year fixed rate mortgage at 4.75% with one loan discount point ($3,000). The monthly principal & interest payment is $1.564.94.

Now the monthly savings as a result of paying one point is $29.42 ($1,594.36 – $1,564.94) and the breakeven point is 101.9 months, or 8 years 6 months. You may still reason that you’ll be in the house longer than 8 ½ years, and you may still determine that it’s worth it to pay the point. At least you can make that choice with factual information.

The decision can be more challenging when you consider the following:

- the lack of an appropriately funded emergency reserve may lead to credit card debt,

- paying off a credit card with a $3,000 remaining balance may result in a monthly savings of $100 or more,

- paying off an auto loan with a $3,000 remaining balance may result in a monthly savings of $250 or more, or

- investing the money in an account earning a rate of return this is greater than the interest rate on your mortgage may be more financially beneficial.

Something else to consider: According to a recent study done by the National Association of Realtors (NAR), first-time homebuyers tend to move within 4 to 5 years, and homeowners that are already on their second or third home tend to move every 7 to 9 years.

It may also help to know that loan discount points may be tax deductible, but due to the differences in the tax treatment of loan discount points in a purchase transaction and a refinance transaction, that is beyond the scope of this post.

As you can see, there are a great many things to consider before you decide to pay loan discount points chasing an interest rate. If you are considering paying points call us to schedule a time to discuss your specific situation and we will help you determine whether paying points is in your best interest.

Leave a Comment