https://youtu.be/77ZyGrdTY6I I was recently interviewed by Gary Collins, creator of the Primal Power Method, for a video blog series he is doing on financial health. Gary created the Primal Power Method to help people make educated decisions concerning their health. The Primal Power Method focuses on nutrition and Read More >

Can Your Retirement Savings Survive Another Market Crash?

You might think the answer to that question depends on how much time you have before you retire, and in a way, you’d be right. Conventional wisdom states that the younger one begins saving for retirement, the more time they have to recover from a loss or multiple losses. However, the truth is you can never recover what Read More >

What Makes Your House a Unique Investment?

One of the biggest misconceptions many homeowners have is that their house is the best investment they’ve ever made. Let’s take a closer look. If you purchased a $250,000 house in 1990 and put 100% down (paid $250,000 cash), and sold it in June 2003 for $600,000, you would have realized a $350,000 profit, which is a Read More >

If The Miracle of Compound Interest is Real, Why Aren’t We All Rich?

Throughout our income earning years a significant amount of money will pass through our respective hands. During that time we will transfer a lot of those hard earned dollars to others, such as the IRS, banks, credit card companies, mortgage companies, etc… Some intentionally and some unintentionally. Some of those Read More >

It’s How You Use Debt That Makes the Difference!

There are only three ways to pay for anything you buy: 1) pay cash, 2) borrow (finance), or 3) barter (trade). For many of us paying cash is not an option and, realistically, neither is bartering, which leaves borrowing. Borrowing in and of itself is neither good nor bad. Borrowing is simply a method of paying for Read More >

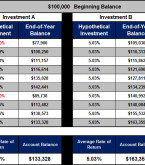

Money Isn’t Math and Math Isn’t Money – Average vs Actual Rate of Return

Today I want to share another example of how money isn’t math and math isn’t money by demonstrating the concepts of average rate of return on an investment and the actual rate of return. Assume you have $100,000 and you have two investment options to choose from and both offered an average rate of return of 5.03%. Read More >