For many aspiring homeowners the biggest obstacle to purchasing a home of their own is coming up with a substantial down payment. This is where the vital role that mortgage insurance plays in the path to homeownership comes in. Mortgage insurance makes it possible for aspiring homeowners to purchase a house with less than a 20% down payment.

For many aspiring homeowners the biggest obstacle to purchasing a home of their own is coming up with a substantial down payment. This is where the vital role that mortgage insurance plays in the path to homeownership comes in. Mortgage insurance makes it possible for aspiring homeowners to purchase a house with less than a 20% down payment.

However, being able to purchase a house sooner and with less than a 20% down payment comes with a price and that price is the cost of mortgage insurance. The lower the down payment the greater the cost of mortgage insurance.

The presence of mortgage insurance in a mortgage loan increases the overall cost of borrowing. I refer to this increased cost of borrowing as the Mortgage Insurance Effect. The best way to understand the Mortgage Insurance Effect is to illustrate it with an example. In this case there are two methods to illustrate this powerful concept.

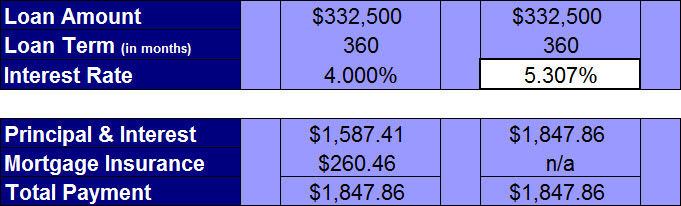

The first method is to consider the impact of mortgage insurance on the entire mortgage amount.

Let’s say you want to purchase a home for $350,000 and you are able to provide a 5% down payment. If you are able to obtain a 30-year fixed rate mortgage for $332,500 at 4.00% your monthly principal & interest payment will be $1,587.41. Because you provided less than a 20% down payment you are required to pay a monthly mortgage insurance premium of $260.46* in addition to the monthly principal & interest payment, which would make your total mortgage-based payment $1,847.86 ($1,587.41 + $260.46).

To illustrate the Mortgage Insurance Effect we have to determine what interest rate will give the same total payment of $1,847.86 if no mortgage insurance was factored in. In other words, if you are able to obtain a 30-year fixed rate mortgage for $332,500 with a monthly principal & interest payment of $1,847.86, what would the interest rate be? The answer is 5.307%.

This means that while you actually have a 4.00% interest rate on your $332,500 mortgage amount, during the period of time that mortgage insurance is required, the effective interest rate you are paying on your mortgage is 5.307%.

This means that while you actually have a 4.00% interest rate on your $332,500 mortgage amount, during the period of time that mortgage insurance is required, the effective interest rate you are paying on your mortgage is 5.307%.

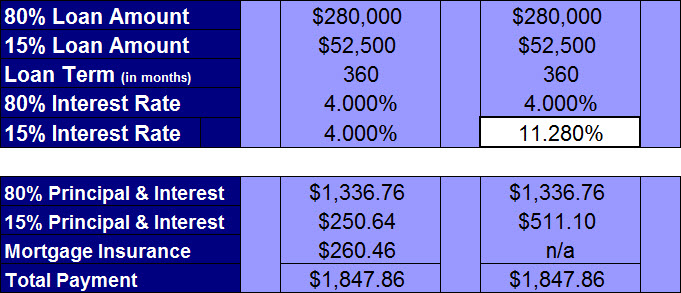

The second method is to consider the impact of mortgage insurance on just the mortgage amount that exceeds 80% of the purchase price since that is the amount that requires mortgage insurance coverage.

To do that we will treat the $332,500 mortgage amount as if there are two individual mortgage loans**. The first mortgage loan will be $280,000, which is 80% of the purchase price ($350,000 x 80%), the second mortgage loan will be $52,500, which is 15% of the purchase price ($350,000 x 15%), and the total mortgage amount is $332,500 ($280,000 + $52,500).

Assuming the same 30 year term and a 4.00% interest rate for each mortgage loan, the monthly principal & interest payment for a $280,000 mortgage amount is $1,336.76. The monthly principal & interest payment for a $52,500 mortgage amount is $250.64. The total principal & interest payments are $1,587.40 ($1,336.76 + $250.64). The monthly mortgage insurance premium is still $260.46* and the total mortgage-based payment is $1,847.86 ($1,336.76 + $250.64 + $260.46).

Since the 80% mortgage loan amounts ($280,000), interest rates (4.00%), loan terms (30 years), and monthly principal & interest payments ($1,336.76) are the same for both first mortgage loans, to illustrate the Mortgage Insurance Effect we have to determine what interest rate would give us a monthly principal & interest payment of $511.11 for a $52,500 mortgage loan for 30 years? The answer is 11.28%.

This means that while you actually have a 4.00% interest rate on the first $280,000 mortgage amount, the effective interest rate on the $52,500 portion of the mortgage amount is 11.28%.

This means that while you actually have a 4.00% interest rate on the first $280,000 mortgage amount, the effective interest rate on the $52,500 portion of the mortgage amount is 11.28%.

The Mortgage Insurance Effect should demonstrate that while the interest rate you secure on your mortgage is an important piece of the mortgage puzzle, there are many other things to consider that may not only be more important, but may have an even bigger financial impact.

*Assumes a credit score between 680 and 719. A credit score higher than 719 would result in a lower monthly mortgage insurance premium and a credit score lower than 680 would result in a higher monthly mortgage insurance premium.

**This example is not to be confused with an actual first mortgage/second mortgage combo, more commonly referred to as a piggyback loan. That is beyond the scope of this blog post.

The only truly bad thing about mortgage insurance is paying the monthly premium one month longer than is absolutely necessary. If you would like to find out what options are available to you to eliminate or bypass monthly mortgage insurance premiums please contact us to schedule a time to talk about your specific circumstances.

Leave a Comment