The cornerstone of any personal financial profile should be establishing and keeping an emergency reserve. You may have heard it referred to as a cash cushion or a rainy day fund. I cannot stress enough the importance of this one simple concept. If you want the upper hand with regard to your personal finances, having a savings account with an amount sufficient to handle the more common of life’s little unbudgeted emergencies will go a long way toward keeping you out of debt and providing you with peace of mind.

The cornerstone of any personal financial profile should be establishing and keeping an emergency reserve. You may have heard it referred to as a cash cushion or a rainy day fund. I cannot stress enough the importance of this one simple concept. If you want the upper hand with regard to your personal finances, having a savings account with an amount sufficient to handle the more common of life’s little unbudgeted emergencies will go a long way toward keeping you out of debt and providing you with peace of mind.

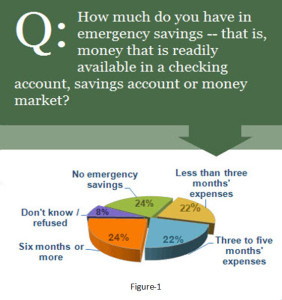

The Wall Street Journal recently reported that regardless of their level of income, 70% of Americans are living from paycheck to paycheck. In addition to that, seventy-six percent of Americans have less than six months’ living expenses in emergency savings.

Consider this: Without an emergency reserve, if a sudden disruption in household income were to occur, anybody is potentially 30 to 60 days away from a late payment on their credit report, and 90 to 120 days away from a Notice of Default and foreclosure, which will negatively impact both their credit score and their credit history for many years to come.

How would missing even one paycheck affect your household finances?

Establishing the Reserve

The first step is to establish a reserve. Ideally, you should have between three and six months’ committed monthly living expenses, depending on your specific circumstances. For many people that may not be possible, initially, so the first milestone is to get one month ahead of your living expenses. If coming up with one month’s living expenses seems too daunting, begin by growing the account to $1,000, then progress to $2,000, and so on.

In order to establish an appropriate reserve it is necessary to calculate the total of your committed monthly living expenses. So what is a committed expense? A committed expense is any expense that you are contractually required to pay and is necessary to your basic standard of living. Committed expenses are things such as your rent payment, mortgage payment, property taxes, homeowners insurance, association dues, water bill, gas & electric bill, auto payment, auto insurance, fuel, groceries, credit card minimum payments, spousal support, child support, child care, etc…

Without a designated emergency reserve, many people, whether they realize it or not, are using their credit cards as their emergency reserve. While there is nothing inherently wrong with credit cards, using them in this manner is a recipe for disaster. In many cases, it is how people first get into credit card debt. For too many people the credit card bridges the gap in cash flow between monthly income and monthly expenses.

Without a designated emergency reserve, many people, whether they realize it or not, are using their credit cards as their emergency reserve. While there is nothing inherently wrong with credit cards, using them in this manner is a recipe for disaster. In many cases, it is how people first get into credit card debt. For too many people the credit card bridges the gap in cash flow between monthly income and monthly expenses.

The problem with this method is the never-ending cycle of debt that this can lead to. It is significantly more difficult to get out of debt when you use credit cards to bridge the gap between your cash flow and expenses. It is more important to establish an emergency reserve than it is to send extra money toward any outstanding debts, including your mortgage.

For many people, a reduction in work hours, a reduction in overtime or bonus income, a death in the family, the need for new tires, an auto tune-up, a new water heater, or any number of unexpected emergencies, would wreak havoc on their family finances.

If you have a designated emergency reserve in place, even if it is only equal to one months’ living expenses, when one of life’s little unbudgeted emergencies comes up, and they will, you can use whatever money is needed to cover the unexpected expense from the emergency reserve without relying on a credit card to get through the circumstance.

If you have a designated emergency reserve in place, even if it is only equal to one months’ living expenses, when one of life’s little unbudgeted emergencies comes up, and they will, you can use whatever money is needed to cover the unexpected expense from the emergency reserve without relying on a credit card to get through the circumstance.

If you find yourself in a situation where it becomes necessary to use the reserve to pay an unexpected expense, begin making minimum monthly payments on any and all outstanding debts and contribute every extra dollar to the reserve account until you replenish the account to the number of month’s living expenses appropriate for your specific circumstances.

If there were opportunities for you to keep more of the money you work so hard for would you want to know how to do that? Call us to find out how you can take back control of your money and finances. We have created a free report that provides a detailed strategy for establishing an emergency reserve of your own. Click here to download a copy of our free report entitled “The Emergency Reserve.”

Leave a Comment