On Wednesday, December 16th, the Federal Reserve (a.k.a. the Fed), in a long-anticipated and long-overdue move, finally raised its benchmark interest rate, the Fed Funds Rate, for the first time in almost a decade. While the Fed only raised the Fed Funds Rate 0.25%, the markets received the news with mixed emotions.

The Fed Funds Rate is the interest rate at which depository institutions (banks and credit unions) lend reserve balances to other depository institutions on an overnight basis. Basically, by increasing the Fed Funds Rate the Fed is attempting to control inflation by lowering the supply of money and making it more expensive to obtain. Inflation is largely the result of too many dollars chasing too few goods and the cheaper money is to borrow the more consumers will borrow it to buy more goods.

Whether you are in the market to purchase a home of your own or you are contemplating refinancing your mortgage, you are likely concerned about how the Fed’s action affects you. Be careful who you listen to when you ask that question. Like you, many assume that the interest rate on 15-year and 30-year fixed rate mortgages increased by the same quarter of a percent. The good news is they did not.

The Fed’s actions do not directly affect long-term interest rates. Mortgage rates are determined by the trading of mortgage-backed securities (mortgage bonds) issued by Fannie Mae, Freddie Mac, and Ginnie Mae. Like stocks, mortgage bonds trade every minute of every trading day and are affected and influenced by economic conditions and inflation expectations.

Consumers will be impacted in the following ways:

Basically, short-term interest rate loans are affected. Credit card rates will be adjusted a bit higher along with HELOC rates, auto loans, and business loans. Theoretically, banks should provide a bump in savings accounts for consumers as banks will now receive a bump in their overnight lending rate…but don’t hold your breath on that happening anytime soon.

I see long-term interest rates remaining low for a long while. That is not to say that long-term interest rates won’t rise. Just that interest rates will remain low for the foreseeable future. I wouldn’t put off buying or refinancing any longer than absolutely necessary, but I wouldn’t panic and rush into anything you may regret.

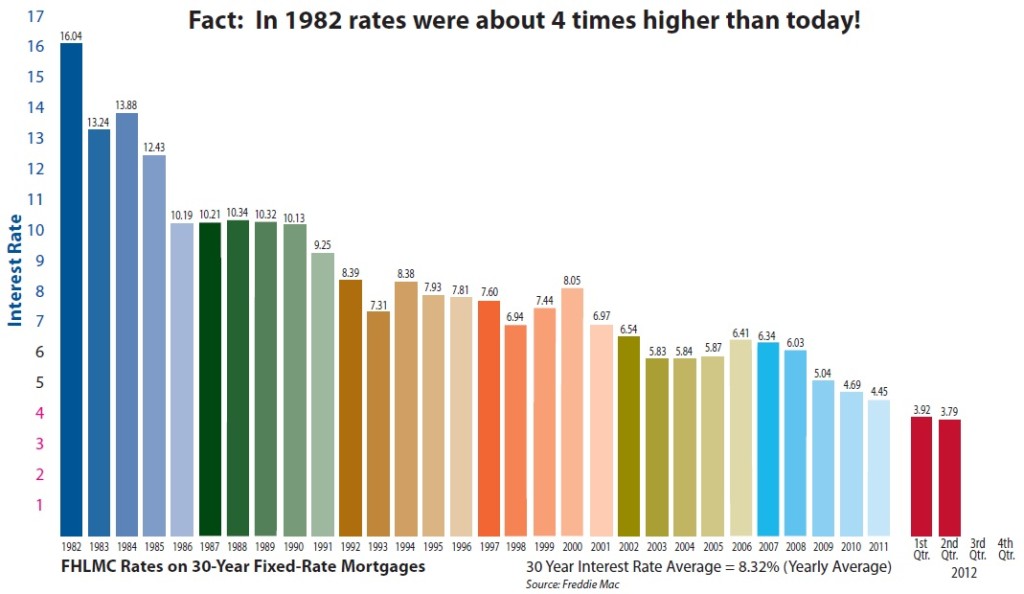

The graphic below, while a little out of date, shows a 30 year history of mortgage rates. The good news is that interest rates have remained in the 4.00% range since 2012. It gives you a glimpse of just how incredibly low interest rates are historically as well as how high they can go.

Please contact me if I can be off assistance.

Leave a Comment