Now there’s a question on a lot of people’s minds, both homeowners and aspiring homeowners alike. There are many reasons why people choose to buy a house, and it is highly likely that chief among those reasons is their belief that over time the house will rise in value. Admit it. If you were certain the house would fall in value, you wouldn’t have bought it. You would have rented instead.

Let me ask this question instead. If you could lock in the price you pay today for a gallon of gasoline for the next 30 years and beyond, would you do it? Is it safe to say you answered ‘Yes’ to that question? This is what you do when you purchase a house of your own. You lock in the amount you will pay for the house each month for the next 30+ years.

Let me ask this question instead. If you could lock in the price you pay today for a gallon of gasoline for the next 30 years and beyond, would you do it? Is it safe to say you answered ‘Yes’ to that question? This is what you do when you purchase a house of your own. You lock in the amount you will pay for the house each month for the next 30+ years.

Let me illustrate with an example. If you purchase a house today for $300,000 and you finance your $300,000 purchase at 5.0% for 30 years, your monthly principal & interest payment will be $1,610. This does not include property taxes, homeowners insurance, or mortgage insurance, if applicable, which may represent another $375 to $575 per month and bring the total house payment to between $1,985 and $2,185, nor does it consider the tax benefits of owning a house and carrying a mortgage.

If you were to obtain a fixed rate mortgage, the mortgage portion of your monthly payment will remain the same over the term of your mortgage, even as interest rates and house values rise or fall. This is not true of rents.

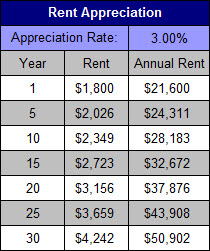

Rents are subject to inflation, as well as supply and demand, and tend to rise by 3 to 5 percent per year, and sometimes more. The rent payment to live in a $300,000 house in San Diego, California, at the time of this post, is about $1,800 per month. Assuming a conservative 3% rate of inflation for rents, the rent payment would be about $2,350 in ten years. In 30 years the rent payment would be about $4,250.

Rents are subject to inflation, as well as supply and demand, and tend to rise by 3 to 5 percent per year, and sometimes more. The rent payment to live in a $300,000 house in San Diego, California, at the time of this post, is about $1,800 per month. Assuming a conservative 3% rate of inflation for rents, the rent payment would be about $2,350 in ten years. In 30 years the rent payment would be about $4,250.

If you could lock in your “rent” payment at $1,985 to $2,185 per month for the next 30 years, thus creating an inflation hedge, would you?

Following conventional wisdom, in 30 years your mortgage would be paid in full, your monthly mortgage payment would be gone, and your housing cost would consist of your bi-annual property tax bill, your annual homeowners insurance premium, and the ongoing maintenance costs associated with an aging house.

If you truly bought your house strictly as an investment then you would sell your house each time the market peaked. Buy low, sell high, right? While we don’t know for sure when the peak is in every market, we can generally tell when a good time to sell is: when everybody is in a frenzy to buy is a pretty good indication that we are at or are approaching a peak.

If you were fortunate enough to sell at the peak you could keep your profit capital gains tax free, if you meet the criteria, and rent a house until the next low in the real estate market occurs. Then you would buy low and wait for the next peak to sell again. But the fact that you don’t do this even once is evidence enough that the house is more than an investment.

While we all want our respective houses to go up in value, it can still make sense to purchase a house even when house values are flat. If you pay rent for the next 30 thirty years, at the end of 30 years you’d have nothing to show for it but 30 years’ worth of rent receipts. Alternatively, if you purchase a house and pay the monthly mortgage payment over the next 30 years, at the end of 30 years you’ll own the house and, if the house never went up in value, you’d have $300,000 in equity (wealth) in the house.

The good news is house prices have an upward bias, and if the house did go up in value at a conservative 3% rate of appreciation, you’d have about $730,000 in equity and you’d be in a position to decide what you want to do with that wealth.

The good news is house prices have an upward bias, and if the house did go up in value at a conservative 3% rate of appreciation, you’d have about $730,000 in equity and you’d be in a position to decide what you want to do with that wealth.

If you’re interested in purchasing or refinancing a house and learning more about renting vs owning, contact us to schedule a time to talk about your specific circumstances.

Leave a Comment