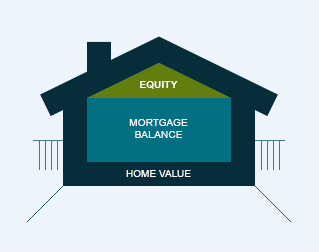

Equity, which I refer to as wealth in the house, is the difference between the value of your house at any given time and the balance of any outstanding liabilities, such as a 1st mortgage, equity line of credit, etc… attached to the house at that same time. For example, if your house is worth $350,000 and the current mortgage balance is $300,000, you have $50,000 ($350,000 – $300,000) of equity in your house. Equity is simply a measurement between these two values at any given time.

Equity, which I refer to as wealth in the house, is the difference between the value of your house at any given time and the balance of any outstanding liabilities, such as a 1st mortgage, equity line of credit, etc… attached to the house at that same time. For example, if your house is worth $350,000 and the current mortgage balance is $300,000, you have $50,000 ($350,000 – $300,000) of equity in your house. Equity is simply a measurement between these two values at any given time.

Equity can change in only two ways:

- Market Appreciation or Depreciation

- Principal Reduction

ALL real estate is local and market appreciation or depreciation is based upon the supply and demand for housing in a particular area. For example, the value of a house in San Diego is not affected by the number of foreclosures in Florida or the level of unemployment in Michigan. Of course, the overall condition and appearance of a house also affects its value, as does the availability of real estate financing.

Principal reduction occurs when a homeowner provides a down payment, a lump sum payment, or additional principal payments to a lender to reduce an outstanding mortgage balance.

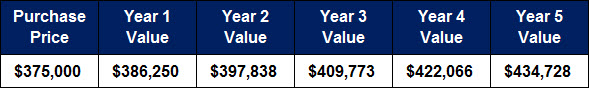

Your equity is constantly changing in accordance with the amount of principal you pay monthly and fluctuations in the value of your house. Let’s look at an example. You purchase a $375,000 house and put 20% ($75,000) down and carry a $300,000 mortgage at 5.0% for 30 years. The principal and interest payment is $1,610.46. The interest portion of the payment is $1,250.00 and the principal portion is $360.46.

Assuming a static, or fixed, principal payment of $360.46 over 60 months, your equity would increase by $21,627.60 ($360.46 x 60) because you have paid the loan balance down. Stated another way, you moved $21,627.60 of your hard earned money from your checking account, where the money was under your use and control, into your house, where the money is no longer under your use and control. The money is no longer under your use and control because once money is placed in the house (given to the lender) there are only two ways to get it back out: 1) sell the house, or 2) borrow against the house.

Key Understanding: Selling the house provides complete use and control of the wealth in the house, but you give up use and control of the house itself. Borrowing against the house provides complete use and control of the wealth in the house and complete use and control of the house, as long as you make the regularly scheduled monthly payments on the mortgage.

If, over that same 5 years, the value of the house were to increase by just 3.0% per year, your house would be worth $434,728. Your equity would increase by $59,728 ($434,728 – $375,000) due solely to market appreciation.

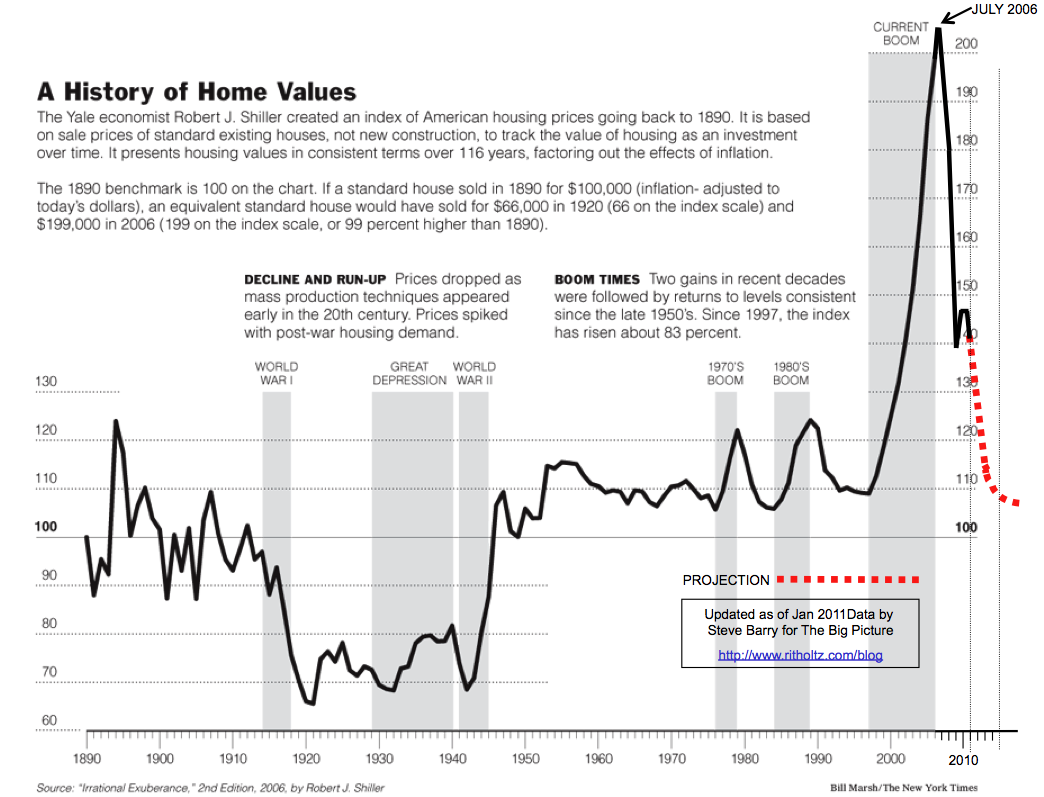

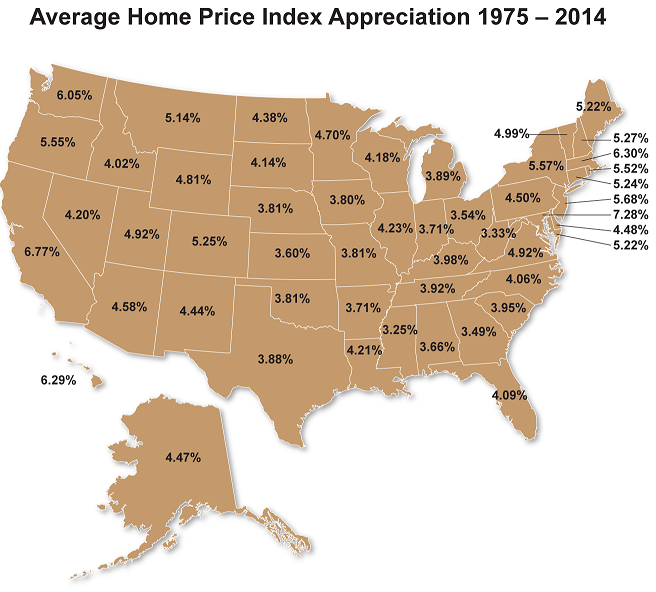

I know you’re thinking where am I going to get a 3.0% rate of appreciation, but from 1997 to 2006 we far exceeded that and we have far exceeded that in the years since the housing and mortgage crisis? In fact, according to the Average Appreciation by State Housing Price Index, 1975 – 2014 graphic, California has an average rate of appreciation of 6.77% in spite of a housing crisis in each of the last 4 decades, so I am being conservative in my example by using 3.0%.

Of the two ways equity can change, market appreciation or depreciation and principal reduction, market appreciation returned $59,728 and principal reduction returned $21,628 over the same period of time. The market did far more to build equity for you than your principal payments did and you didn’t have to give up use and control of your wealth. Could that wealth have provided greater security to you had it been put to work elsewhere?

There is little a homeowner can do to affect the market appreciation or depreciation of their house, but the growth of wealth in the house via principal reduction is entirely under each homeowner’s control. The primary reason homeowners locate their wealth in the house is to reduce the interest they pay to the mortgage company over time and, ultimately, to eliminate the mortgage.

If you’re interested in learning more about the safest, quickest, and most efficient method for paying your mortgage off contact us to schedule a time to talk about your specific circumstances.

Leave a Comment