Let’s review. Up to this point you’ve been contributing pre-tax dollars to a qualified plan. The money in your qualified plan has been increasing and decreasing based on the performance of the investments you have chosen in your plan. You have deferred the taxes due on the dollars you contributed to the plan as well as Read More >

Archives for September 2014

At What Age Does Tax Law Permit You to Withdraw Money from a Qualified Plan?

If you said 59 ½, you’re wrong. If you said 70 ½, you’re wrong. The truth is it’s a trick question. The correct answer is: Tax law lets you withdraw money whenever you want, regardless of your age. Withdrawal means permanently removing money from your account. The IRS doesn’t care when you withdraw the money. Read More >

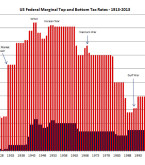

Is Postponing Tax Really the Best Idea?

Let’s say you wanted to borrow $10,000. What questions would you ask and want to know the answers to before you borrowed the money? I can think of at least two key questions, and probably more. What is the interest rate? How much interest do you have to pay? What is the payment? If the lender responded by Read More >

How Much of Your Qualified Plan Balance is Yours?

If you’re like most people who I ask that question, you said “All of it!” But is that true? Remember, you have elected to defer paying the tax. Let’s look at an example. Assume you are in a 30% tax bracket and you wish to make an annual contribution of $6,000 to your qualified plan. The best anyone could and should Read More >

The Value of an Employer Matching Contribution

Many employers that offer qualified plans will partially or fully “match” each employee’s contribution to the plan. Not all employers offer a match, but many do, and the match amount and terms can vary widely among employers. A typical match scenario might look like this: Employer will contribute 50% of the employee’s Read More >