Now there’s a question on a lot of people’s minds, both homeowners and aspiring homeowners alike. There are many reasons why people choose to buy a house, and it is highly likely that chief among those reasons is their belief that over time the house will rise in value. Admit it. If you were certain the house would Read More >

Archives for March 2015

How Does Real Estate Act as an Inflation Hedge?

In order to answer that question it is important to understand the answers to the following three questions? What is a hedge? What is inflation? What is an inflation hedge? A hedge is a risk management strategy used in limiting or offsetting the probability of loss from fluctuations in the price of Read More >

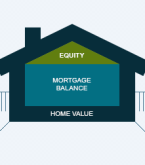

What is House Equity and How Does it Change?

Equity, which I refer to as wealth in the house, is the difference between the value of your house at any given time and the balance of any outstanding liabilities, such as a 1st mortgage, equity line of credit, etc… attached to the house at that same time. For example, if your house is worth $350,000 and the current Read More >

What Drives Real Estate Values?

Your house is part of a general housing market. If the market as a whole is rising or falling, it may influence the value of your house in ways over which you may have little control. However, ALL real estate is local. The value of a house in San Diego is not affected by the number of foreclosures in Florida or the Read More >

Who Is More Secure When You Park Your Wealth in the House?

To answer that question it is necessary to point out that there are three methods by which homeowners park their wealth in the house: 1) providing a down payment when they purchase a house, 2) making principal payments on their mortgage, and 3) market appreciation. The first two methods are almost completely under Read More >