For many aspiring homeowners the biggest obstacle to purchasing a home of their own is coming up with a substantial down payment. This is where the vital role that mortgage insurance plays in the path to homeownership comes in. Mortgage insurance makes it possible for aspiring homeowners to purchase a house with less Read More >

Is Mortgage Insurance Dr. Jekyll or Mr. Hyde?

Mortgage insurance is often seen as or referred to as a necessary evil. It’s a lot like life insurance, or any type of insurance for that matter, in that nobody likes paying the premiums, but they sure like it when they need to make a claim. When I’m asked to explain mortgage insurance I usually begin by comparing Read More >

What is Mortgage Insurance and Why Do I Have to Pay It?

Mortgage insurance is not to be confused with homeowners insurance or mortgage life insurance. Homeowners insurance is intended to protect a homeowner, and the lender, from the loss of the house in the event of a fire. Mortgage life insurance is intended to protect a surviving spouse by paying off the mortgage in the Read More >

What If I Buy a House and the Value Never Goes Up?

Now there’s a question on a lot of people’s minds, both homeowners and aspiring homeowners alike. There are many reasons why people choose to buy a house, and it is highly likely that chief among those reasons is their belief that over time the house will rise in value. Admit it. If you were certain the house would Read More >

How Does Real Estate Act as an Inflation Hedge?

In order to answer that question it is important to understand the answers to the following three questions? What is a hedge? What is inflation? What is an inflation hedge? A hedge is a risk management strategy used in limiting or offsetting the probability of loss from fluctuations in the price of Read More >

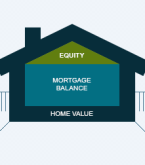

What is House Equity and How Does it Change?

Equity, which I refer to as wealth in the house, is the difference between the value of your house at any given time and the balance of any outstanding liabilities, such as a 1st mortgage, equity line of credit, etc… attached to the house at that same time. For example, if your house is worth $350,000 and the current Read More >