On December 18, 2015, as part of the Protecting Americans from Tax Hikes (PATH) Act of 2015, the President signed legislation that retroactively renews the tax deductibility of mortgage insurance (MI) premiums for qualified borrowers through 2016. The deductibility is effective for purchase and refinance Read More >

What is the Worst Thing About Mortgage Insurance?

The worst thing about mortgage insurance is paying the monthly premium one month longer than is absolutely necessary. It seems like you have to pay mortgage insurance premiums forever, doesn’t it? The good news is you don’t. However, there are rules regarding mortgage insurance that must be understood and adhered to if Read More >

The Mortgage Insurance Effect? What’s That?

For many aspiring homeowners the biggest obstacle to purchasing a home of their own is coming up with a substantial down payment. This is where the vital role that mortgage insurance plays in the path to homeownership comes in. Mortgage insurance makes it possible for aspiring homeowners to purchase a house with less Read More >

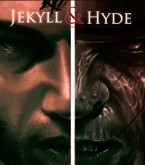

Is Mortgage Insurance Dr. Jekyll or Mr. Hyde?

Mortgage insurance is often seen as or referred to as a necessary evil. It’s a lot like life insurance, or any type of insurance for that matter, in that nobody likes paying the premiums, but they sure like it when they need to make a claim. When I’m asked to explain mortgage insurance I usually begin by comparing Read More >