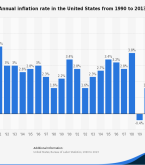

Money is a commodity. It changes in value and can erode over time. Math does not change, which is why we can never make the two synonymous. Let’s explore the impact that inflation has on our daily lives. Inflation has been called many things over time (i.e., a hidden tax, the silent killer, etc…), but what is it Read More >

Money Isn’t Math and Math Isn’t Money – Recovering from Market Losses

Can you recover from stock market losses? That depends on what context you use the word recover. Most people do not realize how much time and money it can take to recover from a steep market dive such as those experienced from 2000 – 2002 and 2007 - 2009. The S&P 500 stock index lost an estimated 46% of its value Read More >

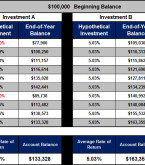

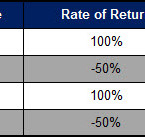

Money Isn’t Math and Math Isn’t Money – Average vs Actual Rate of Return

Today I want to share another example of how money isn’t math and math isn’t money by demonstrating the concepts of average rate of return on an investment and the actual rate of return. Assume you have $100,000 and you have two investment options to choose from and both offered an average rate of return of 5.03%. Read More >

Money Isn’t Math and Math Isn’t Money – Average Rate of Return

The financial media and traditional financial advisors have us trained to make decisions based on numbers on a piece of paper. However, in my experience, money isn’t math and math isn’t money. Placing too much importance on numbers and allowing them to dictate our financial decisions is very similar to confusing the Read More >