Have you ever wondered if your house is a good investment? Chances are you have. Let’s face it; you bought a house because you believed it would rise in value over time. Admit it. If you were certain it would fall in value, you wouldn’t have bought it. You would have rented instead. For many Americans, the house has Read More >

What Are Lenders Looking For? Character!

When a lender is confronted with a borrower seeking financing they are looking for the 4 Cs of borrowing. In a post entitled "What is the Greatest Obstacle To Borrowing Money to Purchase a House?" I explained what the 4 Cs of borrowing are. In this post I intend to get much more specific as to what the lender is Read More >

What is the Greatest Obstacle to Borrowing Money to Purchase a House?

The 4 Cs of Borrowing In a post entitled “The Power of Pre-Approval vs Prequalification” I explained that it is important to get prequalified before you begin your home search, and I further explained that if you are serious about purchasing a home of your own you should take it a step farther and get Read More >

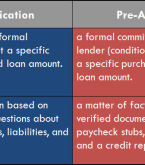

The Power of Pre-Approval vs Prequalification

In a post entitled “So, You Want to Buy a House?” I stated that the first step in buying a house is to determine how you intend to pay for the house. The two ways to pay for a house are to 1) pay cash, or 2) finance. If paying cash isn’t an option for you, the next step is to get prequalified to determine how much Read More >

So, You Want to Buy a House?

You’ve thought about it, you’ve talked about it, and now you’ve decided you want to buy a house of your very own. But, where do you start? The first step is to determine how you intend to pay for the house. You have two options: 1) pay cash, or 2) finance. The truth is even if you pay cash, you are still choosing to Read More >