According to the Employee Benefit Research Institute, approximately 42% of Americans in the private sector (i.e., non-government workers) are covered by a defined contribution plan such as a 401(k) or IRA. For many that contribute to these types of retirement plans, the primary benefits are the perceived tax savings Read More >

Can You Really Retire on 60% of Your Current Income?

The Social Security Administration reports that when you retire you will be able to get by on 60 to 70 percent of your present income. We completely disagree. We believe there are few people who will be able to retire on 2/3 of what they have a hard time living on while they are working. One major problem with the idea Read More >

At What Age Does Tax Law Permit You to Withdraw Money from a Qualified Plan?

If you said 59 ½, you’re wrong. If you said 70 ½, you’re wrong. The truth is it’s a trick question. The correct answer is: Tax law lets you withdraw money whenever you want, regardless of your age. Withdrawal means permanently removing money from your account. The IRS doesn’t care when you withdraw the money. Read More >

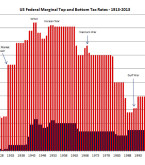

Is Postponing Tax Really the Best Idea?

Let’s say you wanted to borrow $10,000. What questions would you ask and want to know the answers to before you borrowed the money? I can think of at least two key questions, and probably more. What is the interest rate? How much interest do you have to pay? What is the payment? If the lender responded by Read More >

How Much of Your Qualified Plan Balance is Yours?

If you’re like most people who I ask that question, you said “All of it!” But is that true? Remember, you have elected to defer paying the tax. Let’s look at an example. Assume you are in a 30% tax bracket and you wish to make an annual contribution of $6,000 to your qualified plan. The best anyone could and should Read More >