Of course you would! Who wouldn’t? And in all likelihood it would be long overdue. How would that raise in pay impact your monthly income? Let’s consider an example. Assume your employer gave you a raise in pay of $250 per month. How much would you actually get to keep? All of it, right? Not so fast. Your Read More >

Is Financial Stress Taking a Toll on You?

In a March 26, 2015 article entitled “Stress in America Caused by Money,” money topped the list of stressors to Americans, beating out work, family responsibilities, and health concerns. Many Americans have taken steps to cut back on their expenses, including using coupons, cooking more at home, and cutting back on Read More >

Are You Living Paycheck to Paycheck?

If you are, you’re not alone. The Wall Street Journal recently reported that regardless of income, 70% of Americans are living from paycheck to paycheck. As a result, seventy-six percent of Americans have less than six months’ living expenses in emergency savings. Without an emergency reserve, if a sudden disruption Read More >

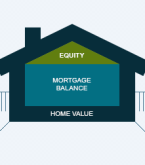

What is House Equity and How Does it Change?

Equity, which I refer to as wealth in the house, is the difference between the value of your house at any given time and the balance of any outstanding liabilities, such as a 1st mortgage, equity line of credit, etc… attached to the house at that same time. For example, if your house is worth $350,000 and the current Read More >

What Drives Real Estate Values?

Your house is part of a general housing market. If the market as a whole is rising or falling, it may influence the value of your house in ways over which you may have little control. However, ALL real estate is local. The value of a house in San Diego is not affected by the number of foreclosures in Florida or the Read More >

Who Is More Secure When You Park Your Wealth in the House?

To answer that question it is necessary to point out that there are three methods by which homeowners park their wealth in the house: 1) providing a down payment when they purchase a house, 2) making principal payments on their mortgage, and 3) market appreciation. The first two methods are almost completely under Read More >