There are only three ways to pay for anything you buy: 1) pay cash, 2) borrow (finance), or 3) barter (trade). For many of us paying cash is not an option and, realistically, neither is bartering, which leaves borrowing. Borrowing in and of itself is neither good nor bad. Borrowing is simply a method of paying for something. In a post entitled “Did You Know That You Finance Everything You Buy?” I explained that whether you pay cash or borrow you finance your purchase.

There may be many reasons that you choose not to borrow money, but there are only two reasons to borrow: 1) you need to, or 2) you choose to. Those who borrow because they need to, do so because they do not have the ability to pay cash. They simply have not accumulated enough capital, or the capital that they do have is not immediately accessible. Those who borrow because they choose to, do so because it is more financially beneficial for them to use other people’s money that it is to use their own.

Let’s consider 3 couples: 1) The Debtors, 2) The Savers, and 3) The Wealth-Creators.

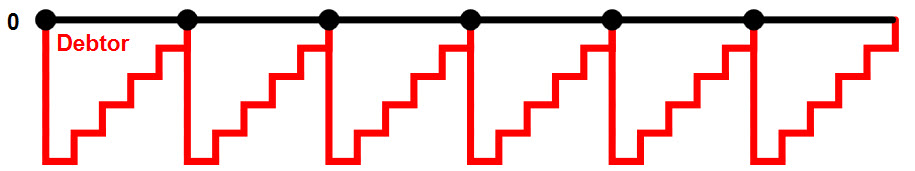

The first couple is the Debtors. They have no money of their own. They have to borrow against their future earnings potential to buy things today. They go into debt and make payments in an attempt to get back to what I refer to as the Zero Line. Unfortunately, for many, there are many things they want and/or need and they are unable to even get back to the zero line before going back into debt, so they compound their debt by going deeper and deeper into debt. Their actions are represented by the following:

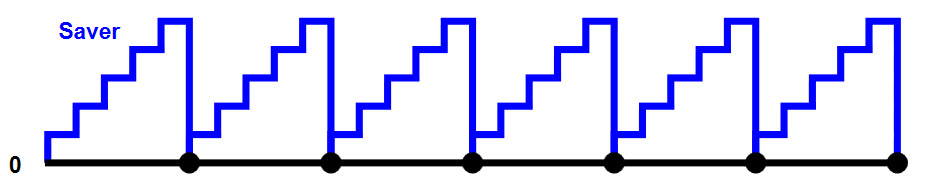

The second couple is the Savers. They save money for that future purchase so they can avoid paying interest. They may even be earning interest while they are saving. Then the purchase comes. They empty their savings account to make their purchase. They go back to the zero line. Their actions are represented by the following:

The second couple is the Savers. They save money for that future purchase so they can avoid paying interest. They may even be earning interest while they are saving. Then the purchase comes. They empty their savings account to make their purchase. They go back to the zero line. Their actions are represented by the following:

The Savers have achieved their goal. They have made their purchase and have no structured payments and pay no interest. However, they do have payments. The Saver’s payments are back to themselves to replenish their savings in preparation for their next future purchase. While they aren’t paying any interest, they are no longer earning interest because they emptied their savings and, more than likely, aren’t paying themselves the interest they are losing either.

The Savers have achieved their goal. They have made their purchase and have no structured payments and pay no interest. However, they do have payments. The Saver’s payments are back to themselves to replenish their savings in preparation for their next future purchase. While they aren’t paying any interest, they are no longer earning interest because they emptied their savings and, more than likely, aren’t paying themselves the interest they are losing either.

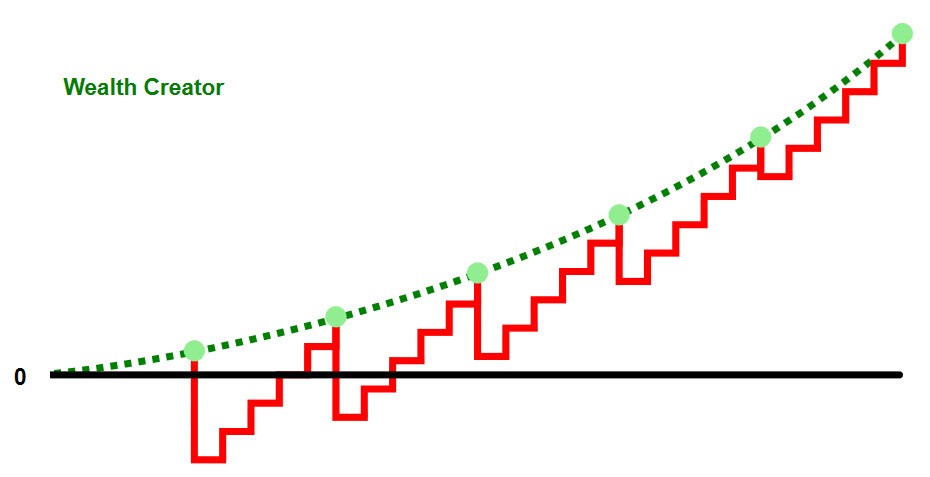

The third couple is the Wealth-Creators. They also have things they want to buy. They are saving money and earning interest just like our second couple, the Savers. But when it comes time to make a purchase, the Wealth-Creators borrow against their savings, not from their savings. They use other people’s money and make simple interest payments to the lender at the best interest rates and terms, while their funds continue to grow. They keep their money compounding and ensure the compounding is uninterrupted. Their actions are represented by the following:

All three of these strategies borrow. The Debtors borrow from a lender, typically at the highest interest rates, using future earnings potential as collateral. They don’t get to set the interest rate at which they borrow. The lender does.

The Savers borrow from themselves. They avoid paying interest, but they reset their compounding cycle and give up the interest they could have earned if they had left their money invested.

The Wealth-Creators also borrower. However, they borrow from a lender of their choosing and they get to borrow at negotiated interest rates. They use their own money as collateral, which gets them the best deal, and their money continues to earn uninterrupted compound interest.

Paying interest is unavoidable. However, paying interest to earn more interest is a key to building wealth.

If you’re interested in learning more about what to consider when determining which form of financing is best for a major capital purchase download our FREE report entitled “Is Paying Cash Detrimental to Your Financial Health?” We also encourage you to contact us to schedule a time to talk about your specific circumstances.

Leave a Comment