Money is a commodity. It changes in value and can erode over time. Math does not change, which is why we can never make the two synonymous.

Let’s explore the impact that inflation has on our daily lives.

Inflation has been called many things over time (i.e., a hidden tax, the silent killer, etc…), but what is it really? Inflation is defined as the general increase in the price of goods and services that your money can be exchanged for or buy. Inflation is as inevitable as it is inescapable and it is crucial for you to understand its effects on you, your standard of living, and your ability to create and build wealth.

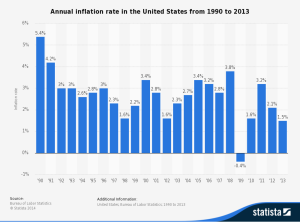

The Federal Reserve says that the average annual rate of inflation over the last 30+ years is 3.0%. Over time, the purchasing power of your money is eroded by inflation. An inflation rate of just 3 percent means that what costs $10,000 today will cost $10,300 next year. In other words, your $10,000 today will only be worth $9,700 next year. In thirty years, using only a 3 percent inflation rate, the same $10,000 would be worth only $4,120, a decline of 59 percent in purchasing power. If I put $10,000 in a can and bury that can in my back yard and I dig it up 30 years later, it would still be $10,000, however, it would be able to purchase $4,120 worth of goods and services.

The math says that $10,000 is still $10,000 regardless of how much time has elapsed. The money, however, has lost much of its value and won’t buy what it used to buy. Its value has been eroded by inflation and lost much of its purchasing power.

The increasing cost of goods and services from a price standpoint is an obvious sign of inflation, but what about the price increases we don’t see?

Examples would be:

- Bottled water went from a 28-pack to a 24-pack with no price change

- Fast food restaurants have decreased the size of their food products or put less meat in them

- “The Dimple,” which we see in peanut butter jars, wine bottles, etc… that reduces the amount of product that a container can hold

- Potato chip bags full of air, and on and on and on

In an article entitled “Objects in Store Are Smaller Than They Appear,” Jerry Hirsch writes “Across the supermarket, manufacturers are trimming packages, nipping a half-ounce off that bar of soap, narrowing the width of toilet paper and shrinking the size of ice cream containers. Often the changes are so subtle that they create the illusion that you are buying the same amount.” Click here to download a copy of the article.

Inflation is different for everybody. Inflation for a husband and wife with 6 kids will be different that for a single person with no kids. The idea here is that math says that $10,000 is $10,000 and if that is how much we need to live on today, then that is how much we should need to live on in the future, provided we are buying the same things. However, in the future, the money will say that we need an amount significantly greater to live the same lifestyle because the money has changed in value.

It is imperative that you keep as many of your most valuable dollars as possible under your control and working for you at all times. Your most valuable dollars are the dollars you have today that have yet to erode in value due to the ravages of inflation.

Key Understanding: The value of your money is relative to its ability to maintain its buying power. A mortgage payment gets easier to make over time and acts as a hedge against inflation because the mortgage payment stays the same as your income increases.

If you’re interested in learning more about the impact inflation has in your financial life please call us to schedule a time to talk.

Leave a Comment