You’ve thought about it, you’ve talked about it, and now you’ve decided you want to buy a house of your very own. But, where do you start?

The first step is to determine how you intend to pay for the house. You have two options: 1) pay cash, or 2) finance. The truth is even if you pay cash, you are still choosing to finance. You have simply chosen to self-finance. Instead of borrowing money from a mortgage company, you take money from your own savings or investment account and pay cash for the house. You may have avoided paying interest to a mortgage company, but you have also given up the opportunity to earn interest on your money.

The real decision, and one that should be getting more consideration, is which method is the most efficient method of financing.

If paying cash is an option for you, before you decide to pay cash, there are many things you should consider, however, they are beyond the scope of this post. For more information on these considerations, feel free to contact us to schedule a time to talk or click here to download my FREE report entitled “Is Paying Cash Detrimental to Your Financial Health?”

If paying cash isn’t an option for you, then the decision of whether to pay cash or finance the house purchase is already made. Once the decision of how to pay for the house has been made, it is time to talk with a mortgage professional to determine how much you can qualify to borrow and the total monthly payment that accompanies that amount, which includes principal & interest, mortgage insurance (if applicable), property taxes, Mello-Roos (if applicable), homeowners insurance, and HOA dues (if applicable). This step is commonly referred to as prequalification, or getting prequalified.

How much you can qualify to borrow will be affected by other monthly debt payments you may have such as child support, spousal support, credit card minimum payments, auto loan payments, student loan payments (whether in deferral or not), 401(k) loan payments, installment loans, etc…

How much you can qualify to borrow can be influenced by the type of financing options available to you (i.e., Conventional, FHA, VA, USDA, etc…). Each type of financing has its own criteria regarding down payment, debt-to-income tolerance, credit history, credit score, etc…

Equally as important as how much you can qualify to borrow, and the corresponding monthly payment, is how much you feel comfortable borrowing, and the maximum total monthly payment you feel comfortable with. There may be a difference between how much monthly payment you can qualify for and how much you feel comfortable with and it could go either way. In other words, you may qualify for a monthly payment that is greater than what you feel comfortable with, and you may feel comfortable with a greater monthly payment than you can qualify for.

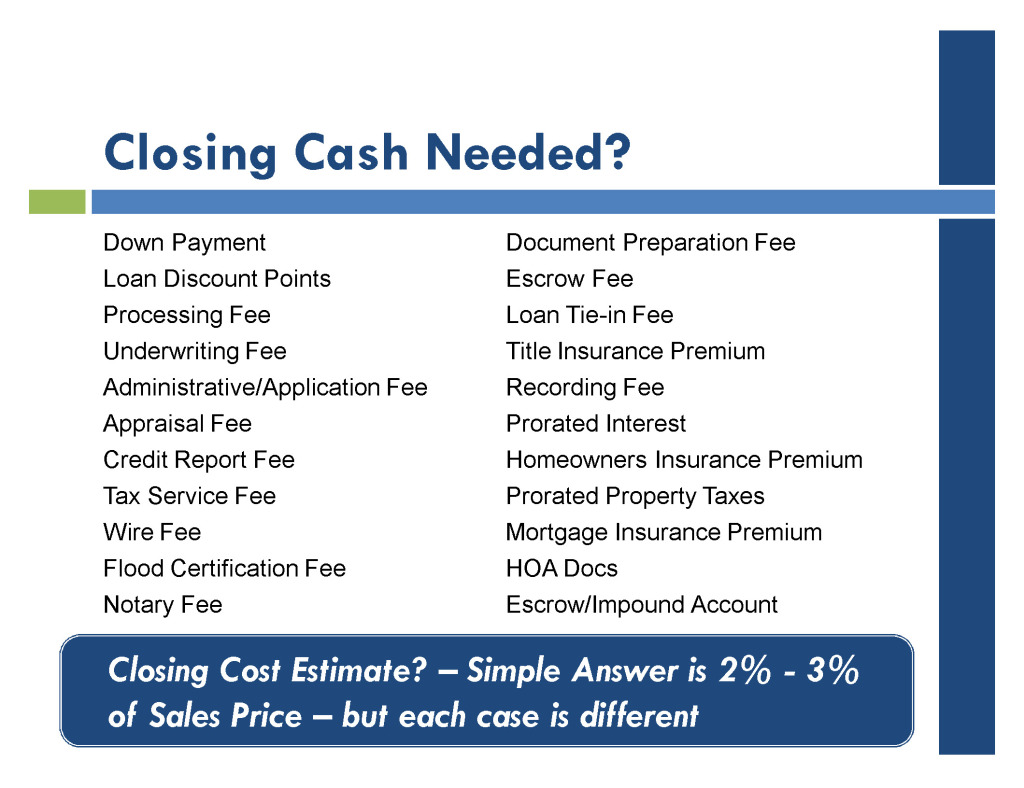

Once you know how much you can qualify for and the monthly payment you feel comfortable with, the next step is determine how much cash you’ll need to complete your purchase. The following graphic is a good representation of the types of fees you may encounter.

Not all of these fees are involved in every transaction and there may be other fees not included in this list.

When the prequalification step is complete, the next step is to get your loan approved. I can’t emphasize enough the importance of working with a mortgage professional who is qualified to give you the proper advice regarding your financing options. Anybody can enter numbers in a calculator to determine a monthly payment, but few are qualified to help you understand the impact that financing your home can have on your overall financial profile.

If you’re interested in learning more about what it takes to purchase a home of your own, you’ll want to read other posts in the series, such as The Power of Pre-Approval vs Prequalification, What is The Greatest Obstacle to Borrowing Money to Purchase a House?, What Are Lenders Looking For? Character!, What Are Lenders Looking For? Capacity!, What Are Lenders Looking For? Collateral!, What Are Lenders Looking For? Credit!, The Two Approvals, and more.

If you’re interested in learning more about what to consider before paying cash for any major capital purchase, download our FREE report entitled “Is Paying Cash Detrimental to Your Financial Health?” We also encourage you to contact us to schedule a time to talk about your specific circumstances.

Leave a Comment