Many em ployers that offer qualified plans will partially or fully “match” each employee’s contribution to the plan. Not all employers offer a match, but many do, and the match amount and terms can vary widely among employers. A typical match scenario might look like this: Employer will contribute 50% of the employee’s contribution up to 3% or 6% of the employee’s salary. I have often heard a 50% employer match referred to as a 50% return on your money and I believe it is important to note that a 50% employer match is not a 50% rate of return.

ployers that offer qualified plans will partially or fully “match” each employee’s contribution to the plan. Not all employers offer a match, but many do, and the match amount and terms can vary widely among employers. A typical match scenario might look like this: Employer will contribute 50% of the employee’s contribution up to 3% or 6% of the employee’s salary. I have often heard a 50% employer match referred to as a 50% return on your money and I believe it is important to note that a 50% employer match is not a 50% rate of return.

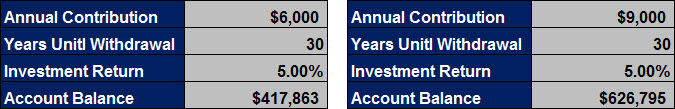

Let me illustrate with an example of a $6,000 per year ($500 per month) employee contribution and a $3,000 per year ($250 per month) employer match. The way to calculate the value of the 50% match by the employer is to compare the difference between an annual contribution of $6,000 without a 50% match and an annual contribution of $9,000 (your $6,000 plus your employer’s $3,000), both earning the same rate of return over the same length of time.

Let’s say you made an annual contribution of $6,000 into your qualified plan for 30 years and you were able to earn 5.00% per year. After 30 years, your $6,000 contributions would be worth $417,863. If your employer matched your contribution with $3,000, at the end of the 30 years at 5.00%, the $9,000 annual contributions would be worth $626,795. That is 50% more than you would have had with just your own $6,000 contributions, which is perfectly logical.

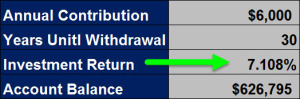

However, that does not equate to a “50% rate of return on your money.” What you need to do is determine the rate of return that your $500 monthly contribution would have to earn in order to grow to $626,795 in thirty years. This calculation gives you an annual rate of return of 7.108%.

In other words, you would have to earn 7.108% annually for thirty years on your $500 monthly contribution in order to end up with the same amount you ended up with by investing $750 monthly that earned 5.00%. This means that the $3,000 employer match was equivalent to a 2.108% (7.108% – 5.00% = 2.108%) increase in the annual rate of return over thirty years, and not the 50% you may have been led to believe.

An employer match of 50% on the employee’s contribution is a 50% return on the contribution itself, not on the account balance. Over time, the employer match may increase the profitability by 2% or 3%, but not by 50%.

If your employer offers a qualified plan and offers to match your contribution you should consider enrolling in the program. Your employer is offering you an incentive to save for your own retirement. This is free money and you should take advantage of this incentive. A good way to look at it is the employer match may end up paying or offsetting the taxes you are deferring.

If you’re interested in learning more about qualified plans download our FREE report entitled “Is Your IRA/401(k) a Ticking Time Bomb?” We also encourage you to contact us to schedule a time to talk about your specific circumstances.

Leave a Comment