In order to answer that question it is important to understand the answers to the following three questions?

In order to answer that question it is important to understand the answers to the following three questions?

- What is a hedge?

- What is inflation?

- What is an inflation hedge?

A hedge is a risk management strategy used in limiting or offsetting the probability of loss from fluctuations in the price of commodities, currencies, or securities.

Inflation is the general increase in the price of goods and services that your money can be exchanged for or buy over time.

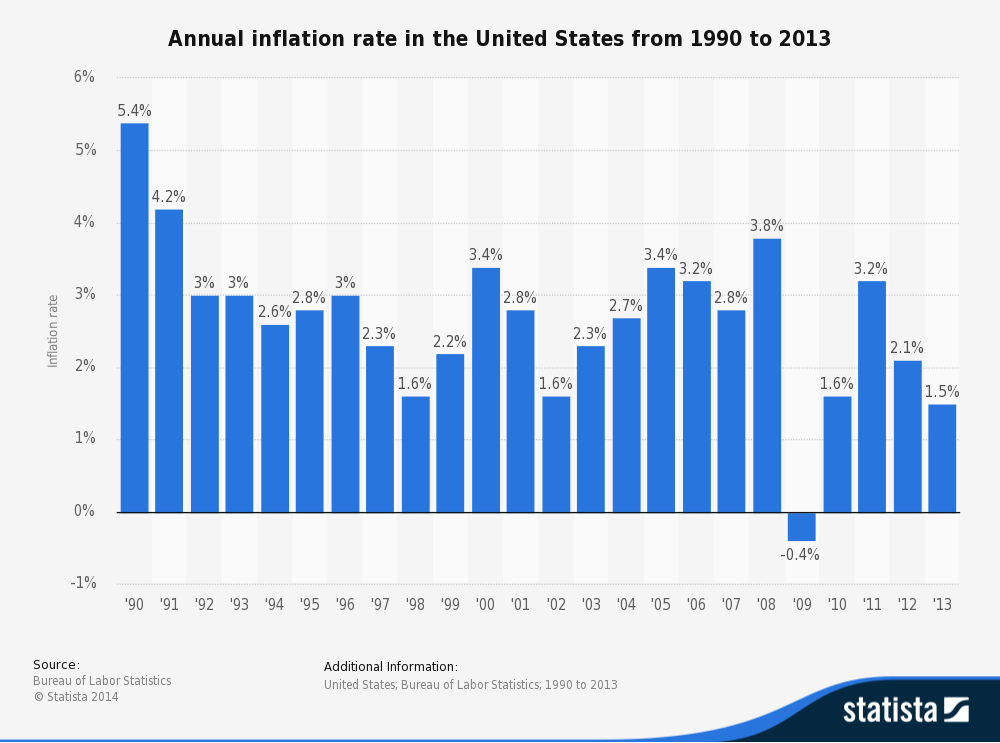

The Federal Reserve says that the average annual rate of inflation over the last 30+ years is 3.0%. Over time, the purchasing power of your money is eroded by inflation. An inflation rate of just 3.0% means that what costs $10,000 today will cost $10,300 next year. The flip side of that is that your $10,000 next year will only be worth $9,700. In thirty years, assuming that same 3.0% inflation rate, the same $10,000 would be worth only $4,120, a decline of 59% in purchasing power.

Key Understanding: The value of your money is relative to its ability to maintain its buying power.

An inflation hedge is anything that provides a form of protection against the effects of inflation.

Now that we have a common understanding of what an inflation hedge is we can better explain how real estate acts as an inflation hedge. We will use the 3.0% inflation rate provided by the Federal Reserve in each example.

Real estate prices are inflationary and driven by supply and demand. When you purchase real estate you typically pay what that piece of real estate is worth at the time of the purchase. What that piece of real estate is or will be worth in the future has no effect on your purchase price or cost of ownership today. This is great news because as the value of real estate increases over time, your cost is fixed, with the exception of property taxes and homeowners insurance. For example, if you purchased a house today for $300,000, your house will cost a prospective buyer about $730,000 in 30 years. If that prospective buyer purchases your house for $730,000 and finances their purchase at 5.0% for 30 years their monthly payment will be about $3,925, and that doesn’t include the considerably higher property tax and homeowners insurance premium. However, because real estate acts as an inflation hedge, your cost of ownership will be based on the $300,000 you paid for the house.

Property taxes, homeowners insurance, and homeowners association dues, if applicable, are an exception because the cost of each will tend to move up or down with market appreciation or depreciation. However, in California, Proposition 13 limits any increase in annual property taxes to 2.0% per year. For example, if your property taxes are $3,000 in a given year, any increase in your property taxes in that year would be limited to $60 ($3,000 x 2%). To my knowledge, homeowners insurance and homeowners association dues have no such limitations.

If you decide to finance your real estate purchase, the mortgage acts as an inflation hedge as well. Now, I know you don’t want a mortgage. What you want is a house. But for most people, to get the house they must obtain a mortgage. If you financed your $300,000 purchase at 5.0% for 30 years, your monthly principal & interest payment will be $1,610. If you obtain a fixed rate mortgage your monthly mortgage payment will remain the same over the term of your mortgage even as interest rates and house values rise or fall [Note: The payment on adjustable rate mortgages may increase independently of inflation].

Consider this: Generally speaking, most people’s incomes rise each year by way of a cost of living adjustment. As a result, your mortgage payment gets easier to make over time. For example, 30 years from now that $1,610 monthly payment will feel like $663 would be like today.

Key Understanding: Over time, your mortgage payment will account for a smaller and smaller percentage of your monthly income. The only way your mortgage payment can be subject to inflation is if you choose to refinance and interest rates are higher at that time.

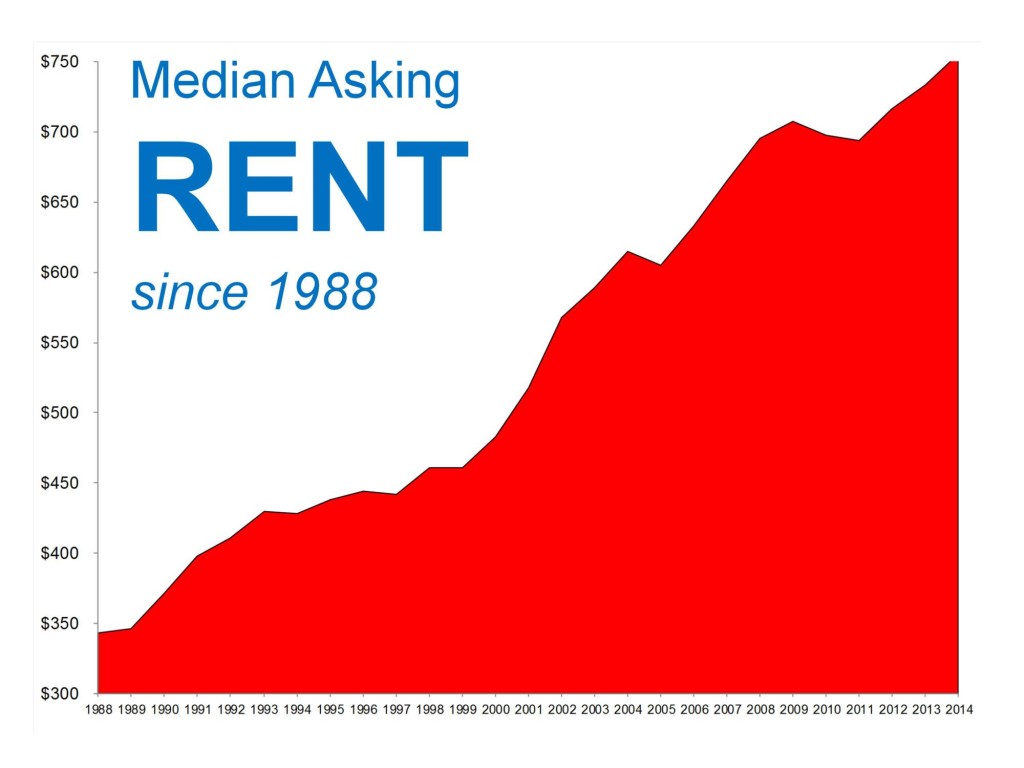

This is not necessarily true if you are renting. Rents are subject to inflation, as well as supply and demand, and tend to rise by 3 to 5 percent per year, and sometimes more. As a result, rents will continue to eat up roughly the same percentage of your income as time goes on. For example, the rent payment to live in a $300,000 house in San Diego, California, at the time of this post, is about $1,800 per month. Assuming a conservative 3% rate of inflation for rents, the rent payment would be about $2,425 in ten years. In 30 years the rent payment would be about $4,375. If this sounds unbelievable, ask your grandparents what they paid in rent or what their mortgage payment was 30 years ago.

The graphic below shows the median rental amount from 1988 through 2014 and the median rental inflation rate is about 3.59%. The median rental amount is the amount that divides the rents paid into two equal groups, half paying rent above that amount, and half paying rent below that amount. It is important to note that ALL real estate is local and some areas are more expensive to live in than others, and as such, their rents may climb at a faster pace.

How does owning real estate stack up against renting five, ten, twenty, and thirty years from now? As time goes on, your house purchase today becomes more and more affordable because real estate and mortgages both act as an inflation hedges.

If you’re interested in purchasing or refinancing a house and learning more about renting vs owning, contact us to schedule a time to talk about your specific circumstances.

Leave a Comment