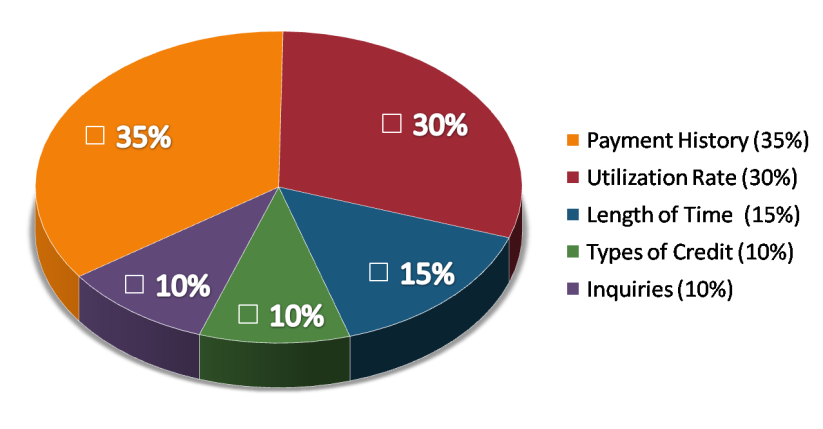

While there are 22 criteria that determine a credit score, they can be narrowed down to 5 ‘key’ criteria. Let’s look at what each category measures and some of the primary ways you earn or lose points for your individual score.

1) Payment History – This represents 35% of your credit score and is the history of your payments weighted to the most recent activity. You lose more points for recent negative payment activity than older negative payment activity. Over time, late payments have a lesser and lesser impact on your credit score as creditors want to know what’s happening for you now.

2) Utilization Rate – This represents 30% of your credit score and is the percentage of available credit that you use on any given account based on your high credit limit for that account. You tend to earn points when you utilize less than 30% of your high credit limit on revolving credit and begin to lose points as you exceed 30% of your high credit limit.

3) Length of Time – This represents 15% of your credit score and is the length of time your accounts have been opened. You have an overall age of all your accounts that goes up or down over time. Any time you open a new account it reduces the average age for all accounts, which temporarily reduces your overall score as you build a history of making payments on the new account. Closing an older account could negatively impact your credit for the same reason. As a rule of thumb, new accounts tend to cost you points for the first 12 months, are neutral for the next 12 months, and gain you points after 24 months of on time payments.

4) Types of Credit – This represents 10% of your credit score and is the varying types of credit you have open at any given time. To ensure access to the highest credit score you want to have at least one major installment account (mortgage), one other installment account (auto), and three (3) revolving accounts (credit cards). Too few accounts, or none that are currently active, and you’ll likely see a lower credit score. You gain points by having a good mix of credit types that show you continue to have an ability and willingness to manage your borrowing.

5) Inquiries and New Accounts – This represents 10% of your credit score and is the number of inquiries made into your credit history in a specified period of time and the number of accounts opened as a result of those inquiries. An inquiry can have a varying degree of impact on your credit score. If multiple creditors request a copy of your credit history for a single new account all those inquiries are counted as one (1) hard inquiry on your credit report if they happen within 45 days of the first inquiry. While inquiries stay on your credit report for two (2) years, they only potentially reduce your credit score for the first twelve (12) months.

A credit score takes into consideration all these categories of information, not just one or two. No one piece of information or factor alone will determine your credit score. The importance of any factor depends on the overall information in your credit report.

Your credit score is something you should manage on a proactive basis. Improving your credit score can help you:

- Get better credit offers

- Lower your interest rates

- Speed up credit approvals

Hopefully, you have a better understanding of what a credit score is. For more information on credit and credit scoring download our FREE report entitled “Credit Scoring and Wealth – The Game of Credit.”

I will explain a strategy for monitoring your credit score in another post so be sure to check back.

Leave a Comment