Many first time homebuyers are told there are tax benefits to owning a home, however, few people can explain what those tax benefits are beyond the tax-deductibility of mortgage interest. In fact, many homeowners aren’t even aware of the tax benefits. The benefits are slightly different for purchase transactions than for refinance transactions and I will focus this post on purchase transactions.

Many first time homebuyers are told there are tax benefits to owning a home, however, few people can explain what those tax benefits are beyond the tax-deductibility of mortgage interest. In fact, many homeowners aren’t even aware of the tax benefits. The benefits are slightly different for purchase transactions than for refinance transactions and I will focus this post on purchase transactions.

Following is a quick list of tax deductible items in a real estate purchase transaction:

- Mortgage Interest

- Property Taxes

- Loan Discount Points

- Loan Origination Fees

- Mortgage Insurance Premiums (although currently awaiting renewal by Congress with no guarantee they will)

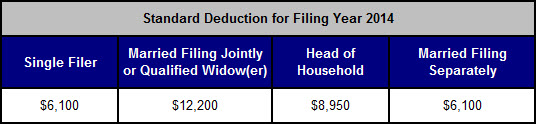

Tax law allows an income tax filer to claim either the itemized deduction or the standard deduction on their tax return, whichever is greater. Regardless of which deduction a tax filer utilizes, that amount of money is free from taxation, so it would make sense that a filer would want as much of their income free from taxation as possible. However, without a mortgage interest deduction, few people have enough deductions to benefit from itemizing their deductions.

The standard deduction amounts for 2013 (the 2014 filing year) are listed below:

In 1986, Congress passed the Tax Reform Act of 1986, which eliminated the tax deductibility of interest on consumer loans, such as credit cards and auto loans, among other things. The deductibility of mortgage interest and interest on business debt is about all that survived.

Under Section 163 of the IRS code, and spelled out in IRS Publication 936 (2013), interest on loans used to acquire, construct, or substantially improve a qualified home, known as acquisition debt, is deductible on up to a $1 million mortgage amount for a married couple filing jointly ($500,000 for a single filer or married filing separate). Interest on loans used for any purpose, known as home equity debt, is deductible on up to a $100,000 mortgage amount for a married couple filing jointly ($50,000 for a single filer or married filing separate), for a total mortgage amount of $1,100,000. In other words, every dollar a homeowner pays in mortgage interest on a mortgage amount of up to $1.1 million is tax deductible in the year paid, unless the homeowner’s income is greater than the income limitations placed on itemized deductions and they are phased-out. A qualified home is defined as both a primary and secondary residence.

Property taxes are also fully tax deductible in the calendar year they are paid. Any loan discount points and/or loan origination fees that are reasonable and customary for the area, whether paid by the borrower or by the seller on behalf of the borrower, are fully tax-deductible in the year incurred, unless they were paid in place of amounts that are ordinarily stated as separate fees on the settlement statement, such as appraisal fees, inspection fees, title fees, attorney fees, etc…

As a result of the Tax Relief and Health Care Act of 2006, for tax years 2007 through 2013, homeowners were able to deduct as an itemized deduction the cost of premiums for qualified mortgage insurance on a qualified home. Qualified mortgage insurance is mortgage insurance provided by the Department of Veterans Affairs (VA), the Federal Housing Administration (FHA), the Rural Housing Service (USDA), and private mortgage insurance. The premiums are deductible as mortgage interest. To be deductible the premiums must have been paid in connection with the acquisition debt on a purchase transaction that closed after December 31, 2006. However, if a homebuyer’s adjusted gross income was greater than the established income limitations, the deductibility of mortgage insurance premiums was either reduced or eliminated altogether.

At the time of this blog post Congress has not yet renewed the Act and unless they do mortgage insurance premiums paid in tax year 2014 will not be eligible as an itemized deduction.

While not a closing cost and certainly not advisable, it is interesting to note that late payment charges are deductible as mortgage interest if the charge was not for a specific service performed in connection with a mortgage loan, as are mortgage prepayment penalties, although prepayment penalties are rarely seen in today’s mortgage environment.

If you’re interested in learning more about what you need to know before purchasing a home of your own, be on the lookout for our soon to be released FREE report entitled “The Simple Truth About Financing Your Home: How to Navigate the Mortgage Maze.” In the meantime, we encourage you to contact us to schedule a time to talk about your specific circumstances.

There are a number of caveats to the tax deductibility of the costs mentioned above, such as the Alternative Minimum Tax, which are beyond the scope of this blog post. This blog post is intended to provide introductory information to the subject matter covered. Neither the company, the advisor, nor their representatives offer tax or legal advice. Consult your attorney or tax advisor as to the applicability of this information to your specific circumstances and for complete up-to-date information concerning federal and state laws in this area.

Leave a Comment