I am often surprised to find out how few homeowners actually understand how the tax benefits of owning a house affects them. So much so that I am compelled to write about it and attempt to explain it in today’s post.

In order for a homeowner to deduct mortgage interest on their income tax return the homeowner must itemize their deductions utilizing IRS form Schedule A. A homeowner would only itemize their deductions if the total of their itemized deductions was greater than the standard deduction that applied to their situation.

In order for a homeowner to deduct mortgage interest on their income tax return the homeowner must itemize their deductions utilizing IRS form Schedule A. A homeowner would only itemize their deductions if the total of their itemized deductions was greater than the standard deduction that applied to their situation.

Regardless of which deduction a homeowner claims, the IRS also allows a personal exemption for each dependent in the family, except for a dependent that is claimed on another taxpayer’s return.

The net effect of claiming the standard deduction, or the itemized deduction, and the personal exemption(s) is a reduction in the income that is subject to tax.

Let me illustrate with the help of a fictitious couple named Joe & Mary Homeowner. Joe & Mary have two children and formerly rented a house for $1,900 per month. They purchased the exact same house next door in January 2013 and now carry a $300,000 mortgage at 5.00% for 30 years. Their monthly mortgage payment is $1,610. Their property taxes are $392 per month and their homeowners insurance is $80 per month, for a total monthly mortgage payment of $2,082. Their household adjusted gross income is $125,000 per year.

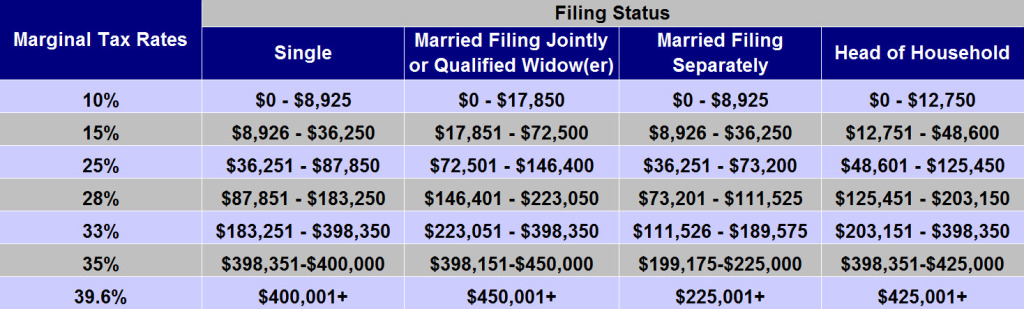

The first step is to locate Joe & Mary’s filing status on the chart below. Then identify the income bracket for their gross income and the corresponding federal marginal tax rate shown to the left.

As you can see, the couple is in the 25% federal marginal tax bracket. Before seeing this tax chart one might have assumed that Joe & Mary’s income tax would be $31,250 ($125,000 x 25%). However, we utilize a progressive income tax system in America, and the real tax calculation is much different, as we will demonstrate.

As you can see, the couple is in the 25% federal marginal tax bracket. Before seeing this tax chart one might have assumed that Joe & Mary’s income tax would be $31,250 ($125,000 x 25%). However, we utilize a progressive income tax system in America, and the real tax calculation is much different, as we will demonstrate.

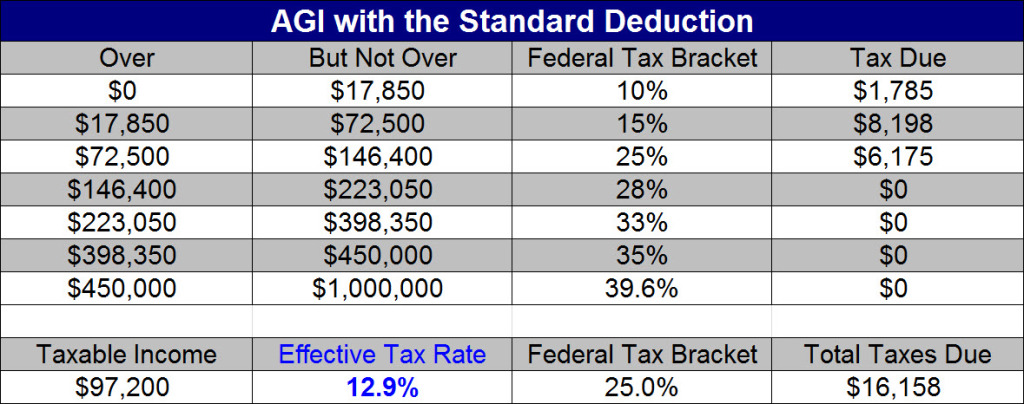

Had Joe & Mary continued to rent the house throughout 2013 their income tax would be calculated as follows:

♦ Their income from $0 to $17,850 would be taxed at 10%, which is $1,785 ($17,850 x 10%).

♦ Their income from $17,851 to $72,500 would be taxed at 15%, which is $8,198 (($72,500 – $17,851 = $54,649) x 15%).

♦ Their income from $72,501 to $125,000 would be taxed at 25%, which is $13,125 (($125,000 – $72,501 = $52,499) x 25%).

Based on the progressive tax system, Joe & Mary would owe $23,108 ($1,785 + $8,198 + $13,125). However, the IRS allows a personal exemption of $3,900 for each dependent for the 2013 tax year, which amounts to $15,600 ($3,900 x 4). Since Joe & Mary have very few tax deductions, they would claim the standard deduction of $12,200. Their total tax deductions equal $27,800 ($15,600 + $12,200), and their taxable income is actually $97,200 ($125,000 – $27,800).

♦ Their income from $72,501 to $97,200 would be taxed at 25%, which is $6,175 (($97,200 – $72,501 = $24,699) x 25%). The actual tax they owe is $16,158 ($1,785 + $8,198 + $6,175).

The standard deduction plus their personal exemptions saved Joe & Mary $6,950 ($13,125 – $6,175) in otherwise payable federal income taxes. Their actual or effective tax rate is 12.9% (($16,158 ÷ $125,000) x 100).

Since Joe & Mary purchased a house they are able to benefit from itemizing their deductions because mortgage interest and property taxes represent a significant amount and will most assuredly be greater than the standard deduction.

When a taxpayer itemizes their deductions the list of eligible deductions include, but are not limited to, the following:

⇒ State income taxes

⇒ Property taxes

⇒ Personal property taxes (e.g., the taxable portion shown on the automobile registration)

⇒ Mortgage interest

⇒ Discount points

⇒ Mortgage insurance (if Congress renews their tax deductibility)

⇒ Investment interest

⇒ Gifts and donations

⇒ Unreimbused employee business expenses (e.g., union dues, job travel, job education, tools, etc…)

⇒ Tax preparation fees

(Unreimbursed employee business expenses and tax preparation fees, plus a few other expenses, may be deductible, but only the amount that exceeds 2% of adjusted gross income)

Joe & Mary Homeowner’s tax deductions include the following:

- State income taxes – $4,800

- Mortgage interest – $15,000

- Property taxes – $4,700

- Personal property taxes – $550

- Gift and donations – $500

- Tax preparation fee – $200

Their total itemized deductions are $25,750.

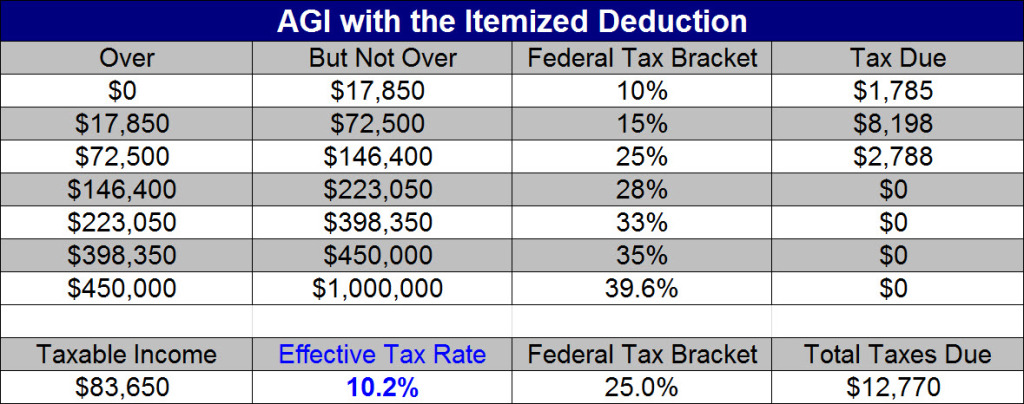

As homeowners, Joe & Mary’s 2013 tax return (filed by April 15, 2014) would look like this:

♦ Their income from $0 to $17,850 is taxed at 10%, which is $1,785 ($17,850 x 10%).

♦ Their income from $17,851 to $72,500 is taxed at 15%, which is $8,198 (($72,500 – $17,851 = $54,649) x 15%).

Joe & Mary’s itemized deductions of $25,750 combined with their personal exemptions of $15,600 ($3,900 x 4) total $41,350 ($25,750 + $15,600), so their taxable income is $83,650 ($125,000 – $41,350).

♦ Their income from $72,501 to $83,650 is taxed at 25%, which is $2,788 (($83,650 – $72,501 = $11,149) x 25%).

Joe & Mary’s total tax is $12,770 ($1,785 + $8,198 + $2,788). Their actual or effective tax rate of 10.2% (($12,770 ÷ $125,000) x 100).

If the tax Joe & Mary paid as a homeowner is $12,770, and the tax they would have paid as a renter is $16,158, then owning a house saved them $3,388 ($16,158 – $12,770) in taxes they would have otherwise paid to the IRS. And this example only demonstrates the federal income tax savings. The taxpayer would also save taxes on their state income tax return if they lived in a state that has an income tax.

This clearly demonstrates that the monthly tax benefit for owning a house in this example is $282 ($3,388 ÷ 12). So, if Joe & Mary’s monthly mortgage payment is $2,082 and the monthly tax benefit of owning a house is $282, their after-tax monthly payment is actually $1,800 ($2,082 – $282). For Joe & Mary, owning ended up being cheaper than renting.

The tax savings that result from itemizing one’s deductions comes off their highest applicable state and federal tax bracket because it reduces the income that is subject to tax. In other words, if a taxpayer is in the 25% federal tax bracket, any income not subject to tax would save the taxpayer 25% in actual tax.

If you’re interested in learning more about what you need to know before purchasing a home of your own, be on the lookout for our soon to be released FREE report entitled “The Simple Truth About Financing Your Home: How to Navigate the Mortgage Maze.” In the meantime, we encourage you to contact us to schedule a time to talk about your specific circumstances.

There are a number of caveats to the tax deductibility of the costs mentioned above, such as the Alternative Minimum Tax, which are beyond the scope of this blog post. This blog post is intended to provide introductory information to the subject matter covered. Neither the company, the advisor, nor their representatives offer tax or legal advice. Consult your attorney or tax advisor as to the applicability of this information to your specific circumstances and for complete up-to-date information concerning federal and state laws in this area.

Leave a Comment