If you’re like most people who I ask that question, you said “All of it!” But is that true? Remember, you have elected to defer paying the tax. Let’s look at an example.

Assume you are in a 30% tax bracket and you wish to make an annual contribution of $6,000 to your qualified plan. The best anyone could and should say is that the apparent tax benefit of making a $6,000 contribution today would be deferral of $1,800 ($6,000 x 30%) in taxes you otherwise would have paid had you not made the contribution. What many miss is the fact that the $1,800 you deferred in taxes today will be due, with interest, in the future.

You contributed $6,000 to the plan, but you only have $4,200 in the plan. The government has their share, $1,800, in the plan as well. Had you claimed the $6,000 as income instead you would have paid your tax of $1,800 and received the balance of $4,200. The government is allowing you to defer the tax. You did not “save” any tax. You did not get a check back in the mail. You simply do not have to pay the tax today.

The money you think you are saving is actually in your qualified plan. The government understands opportunity cost as well. They will want their $1,800 back one day, with interest. Your share will earn interest, and so will theirs.

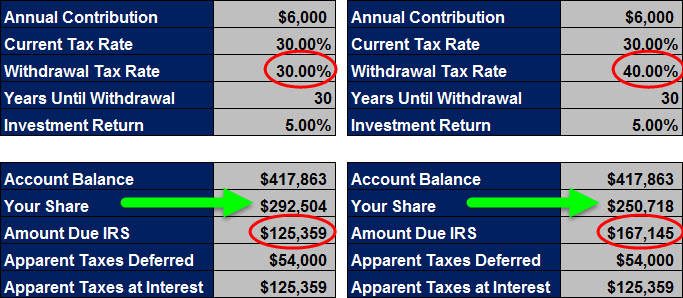

If you were able to earn a 5.00% rate of return, at the end of 30 years your account value would grow to $417,863. The government’s share would be $125,359 ($417,863 x 30.00%) and your share would be $292,504 ($417,863 – $125,359), assuming the same 30% tax bracket. Should they decide they want, or need, more and raise taxes when you start taking the money out, your share will go down. If the government decides to raise taxes and your new tax rate is 40.00%, the government’s share will go up to $167,145 ($417,863 x 40.00%) and your share of your qualified plan will go down to $250,718 ($417,863 – $167,145).

If you contributed $6,000 per year to a qualified plan and did so for 30 years you would have contributed $180,000 ($6,000 x 30). If you’re in a 30% tax bracket you would have deferred $54,000 ($180,000 x 30%) in otherwise payable taxes to some future date. If you could simply write a check to the IRS for $54,000, would you do it? I would in a heartbeat.

Unfortunately, that’s not the way it works. The IRS doesn’t just want the $54,000. They want their share of the growth as well. Remember, qualified plans defer the tax on the contribution as well as the growth. Whatever rate of return you get on your share of that money, the IRS will accept the same return on their share. That’s how the $54,000 you deferred in taxes turned into the roughly $125,359 that you now owe the IRS. You deferred $54,000 in taxes over the course of 30 years, but you’ll be paying back nearly three times that amount during your retirement. Believe it or not, the governement wants you to get the highest rate of return possible because they benefit as well.

Most people will pay back every dollar of taxes they deferred during that 30 years in the first five years of retirement. That means that if you retire at age 65, every year you live past age 70 will cost you more in taxes than you deferred. So whose retirement are you planning? Yours or Uncle Sam’s?

Tax risk is a significant and very underestimated risk! What is the current lien amount on your IRA/401(k)? Who is taking all the risk?

If you’re interested in learning more about qualified plans download our FREE report entitled “Is Your IRA/401(k) a Ticking Time Bomb?” We also encourage you to contact us to schedule a time to talk about your specific circumstances.

Leave a Comment