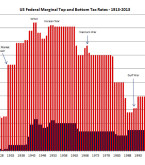

If you believe, as I do, that future tax rates will be higher, you may benefit from opening a Roth IRA. Of the 5 ways people lose money, taxes are NUMBER ONE. There are many innovative strategies for reducing your tax burden and the Roth IRA is without a doubt the best IRA available today. Traditional IRAs allow you Read More >

How Can the Tax Treatment of Real Estate Save a Seller Thousands of Dollars?

Under Section 121 of the IRS Code, and spelled out in IRS Publication 523 (2013), homeowners who sell their primary residence may be able to exclude from income any gain up to a limit of $500,000 if the homeowners are married and file a joint tax return. The limit is $250,000 for a single income tax filer or a married Read More >

Which Closing Costs Are Tax Deductible When You Purchase a House?

Many first time homebuyers are told there are tax benefits to owning a home, however, few people can explain what those tax benefits are beyond the tax-deductibility of mortgage interest. In fact, many homeowners aren’t even aware of the tax benefits. The benefits are slightly different for purchase transactions than Read More >

At What Age Does Tax Law Permit You to Withdraw Money from a Qualified Plan?

If you said 59 ½, you’re wrong. If you said 70 ½, you’re wrong. The truth is it’s a trick question. The correct answer is: Tax law lets you withdraw money whenever you want, regardless of your age. Withdrawal means permanently removing money from your account. The IRS doesn’t care when you withdraw the money. Read More >

Is Postponing Tax Really the Best Idea?

Let’s say you wanted to borrow $10,000. What questions would you ask and want to know the answers to before you borrowed the money? I can think of at least two key questions, and probably more. What is the interest rate? How much interest do you have to pay? What is the payment? If the lender responded by Read More >

How Much of Your Qualified Plan Balance is Yours?

If you’re like most people who I ask that question, you said “All of it!” But is that true? Remember, you have elected to defer paying the tax. Let’s look at an example. Assume you are in a 30% tax bracket and you wish to make an annual contribution of $6,000 to your qualified plan. The best anyone could and should Read More >