On June 6, 1978, nearly two-thirds of California’s voters voted yes and passed Proposition 13, reducing property tax rates on homes, businesses, and farms by about 57%. That was almost 38 years ago and California homeowners still benefit from it today, but I’ll bet only a handful of homeowners realize it and fewer still understand how they benefit from it.

On June 6, 1978, nearly two-thirds of California’s voters voted yes and passed Proposition 13, reducing property tax rates on homes, businesses, and farms by about 57%. That was almost 38 years ago and California homeowners still benefit from it today, but I’ll bet only a handful of homeowners realize it and fewer still understand how they benefit from it.

Prior to the passage of Proposition 13 the property tax rate throughout California averaged a little less than 3% of the current market value of a property and there were no limits on increases either for the tax rate or property value assessments. Property taxes could increase dramatically from year to year based on the assessed value of the property. For example, if a house in a neighborhood sold for a higher price than the neighboring properties’ currently assessed values, those neighboring properties might have been reassessed based on the newly increased area values, resulting in higher property taxes for everybody.

During the 1970s the real estate market experienced dramatic growth and property owners witnessed the rapid escalation in the value of their homes. Because assessors were required to keep assessed values current, property taxes were skyrocketing at a substantial rate. Some properties were reassessed 50% to 100% in just one year and their owners’ tax bills jumped correspondingly.

Consider for a moment how your lifestyle would change if the property tax rate was 3% of the current value of your home. If we assume the current value of your home is $400,000, your annual property tax bill would be $12,000. That would result in a $6,000 payment due by April 10th and another $6,000 payment due by December 10 each year. If you pay your property taxes with your monthly mortgage payment just the tax portion of your payment would be $1,000.

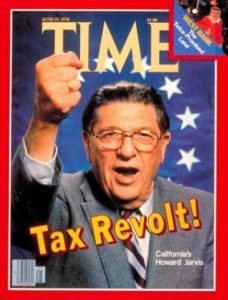

By the late ‘70s California homeowners’ property tax burden was intolerable. For many seniors living on fixed incomes, it meant selling their homes or giving them up to the tax man. That is until Howard Jarvis and the Howard Jarvis Taxpayers Association drafted Proposition 13. The goal was to protect taxpayers from unanticipated increases in property taxes, to provide relief, and to require voter approval of future tax increases. They succeeded.

By the late ‘70s California homeowners’ property tax burden was intolerable. For many seniors living on fixed incomes, it meant selling their homes or giving them up to the tax man. That is until Howard Jarvis and the Howard Jarvis Taxpayers Association drafted Proposition 13. The goal was to protect taxpayers from unanticipated increases in property taxes, to provide relief, and to require voter approval of future tax increases. They succeeded.

When Proposition 13 passed in 1978 it established several objectives that benefit all California homeowners such as:

- For existing homeowners, assessed property values were rolled back to their 1975-76 levels for tax purposes.

- It set a maximum base tax rate of 1% of the assessed value of the property.

- The assessed value of a home can increase annually based on the Consumer Price Index (CPI), but by no more than 2% per year unless a re-assessable event occurs.

Examples of re-assessable events are:

- Completion of new construction

- Change in ownership through sale*

- Material improvements to your property that increase its value

Examples of material improvements are:

- Kitchen remodel

- Bath remodel

- Room addition

- Garage conversion/addition

- Barn/Workshop addition

- Inground pool installation, etc…

A re-assessable event typically triggers a re-assessment when an application for a building permit for the intended improvement is filed. The assessed value of the property is typically increased by the estimated cost of the improvement and a supplemental tax bill will be issued. However, it does not trigger a re-assessment of the value of the property as a whole.

A re-assessable event typically triggers a re-assessment when an application for a building permit for the intended improvement is filed. The assessed value of the property is typically increased by the estimated cost of the improvement and a supplemental tax bill will be issued. However, it does not trigger a re-assessment of the value of the property as a whole.

Proposition 13 also provides important changes that ALL Californians benefit from, such as requiring any measure enacted for the purpose of increasing state revenues to be approved by a two-thirds vote (instead of a simple majority) of each house of the legislature. Additionally, taxes raised by local governments for a designated or special purpose to be approved by two-thirds (instead of a simple majority) of the voters.

Proposition 13 has been successful at what it promised to do. It prevented homeowners from being taxed out of their homes, allowed property owners to finally be able to determine the maximum amount taxes could increase as long as he or she owned the property, and required a supermajority to pass any new taxes or tax increases.

So the next time you pay your property tax bill or you notice on your monthly mortgage payment statement that the lender servicing your mortgage has paid your property tax bill you should remember Proposition 13 and be grateful that the proposition was drafted, made the ballot, and was passed overwhelmingly by California voters.

* There are exceptions to the change in ownership rule such as adding or removing a spouse from title and putting the property into or taking the property out of a Trust, among others.

Leave a Comment