Getting rid of outstanding credit card debt is generally a top priority for most people that have credit card debt, but they either don’t know how to go about doing that, they don’t have the extra money necessary to do it, or both. There’s good news for those that own a home.

Getting rid of outstanding credit card debt is generally a top priority for most people that have credit card debt, but they either don’t know how to go about doing that, they don’t have the extra money necessary to do it, or both. There’s good news for those that own a home.

The quickest and most efficient method for eliminating your debt is to refinance your existing mortgage and take out enough cash to consolidate it. If you have enough equity in your home you can put that equity to work for you by using it to pay off your higher interest rate non-preferred debt.

When you consolidate your debt by combining your credit card debt with your mortgage you are transferring that debt to a more efficient method of financing. The goal is to minimize your interest payments and maximize your cash flow. You can then apply that increase in cash flow to your new mortgage payment and pay the credit card debt off that much quicker without actually increasing your total monthly payments.

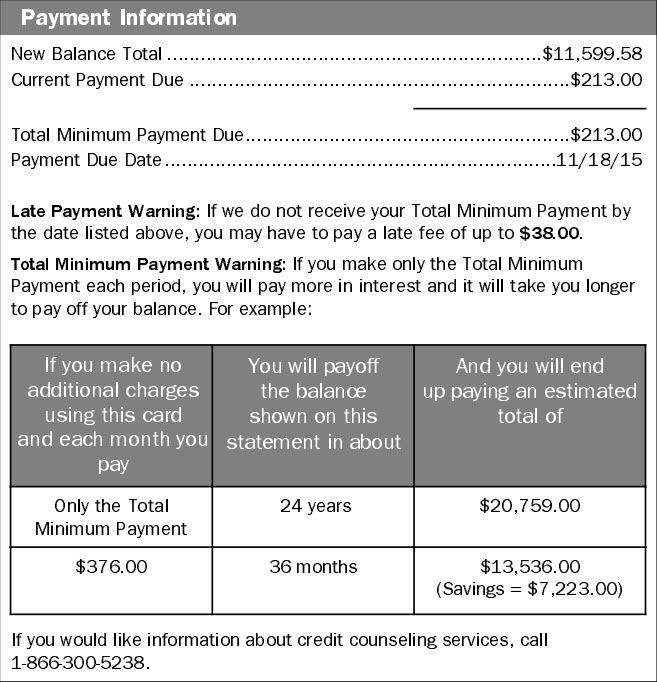

Some would argue that using your mortgage to pay off your credit card debt isn’t a good idea because you would be spreading the repayment of your credit card debt out over 30 years. While that may be true, it seems to be the only time people consider the long-term cost of their debt. The long-term cost of credit card debt can be quite significant as well. Since 2005 credit card companies have been required to show on their monthly statements how long it will take to pay off your credit card account with them as well as how much you will pay in total, and that assumes you make no additional charges with that credit card. Look at the sample statement below.

The statement shows a current balance of $11,599.58 and a minimum payment of $213.00. The first box on the left of the statement shows that making the minimum payment and making no additional charges to this credit card will take 24 years to pay the balance in full and you will have paid just under $9,000 in interest. That is a substantial amount of interest and should not go unnoticed as is usually the case.

For those that want to get rid of their credit card debt, but just can’t bring themselves to divorce their spectacular interest rate (which is so amazing that they can’t wait to pay it off), there is the Home Equity Line of Credit (HELOC) and the Home Equity Loan.

A Home Equity Line of Credit would allow you to consolidate your credit card debt with a low adjustable interest rate second mortgage that has flexible use and repayment terms. A HELOC allows you to make minimum payments of interest only for as long as 10 years and provides up to an additional 20 years to repay the principal balance.

A Home Equity Loan is exactly like a typical first mortgage. You borrow a specific amount at a certain fixed interest rate for a specific loan term (e.g., 10, 15, 20, or 30 years) and you make monthly payments that contain principal and interest. At the end of the term the loan is paid in full.

An additional benefit of consolidating your debt by refinancing your mortgage is that the interest may become preferred interest instead of non-preferred interest and become tax deductible. Under Section 163 of the IRS code, and spelled out in IRS Publication 936 – 2014 – Home Mortgage Interest Deduction, interest on loans used for any purpose, known as home equity debt, is deductible on up to a $100,000 mortgage amount. In other words, every dollar a homeowner pays in mortgage interest on a mortgage amount of up to $100,000 is tax deductible in the year paid, unless the homeowner’s income is greater than the income limitations placed on itemized deductions and they are phased-out or they are subject to the Alternative Minimum Tax (AMT).

An additional benefit of consolidating your debt by refinancing your mortgage is that the interest may become preferred interest instead of non-preferred interest and become tax deductible. Under Section 163 of the IRS code, and spelled out in IRS Publication 936 – 2014 – Home Mortgage Interest Deduction, interest on loans used for any purpose, known as home equity debt, is deductible on up to a $100,000 mortgage amount. In other words, every dollar a homeowner pays in mortgage interest on a mortgage amount of up to $100,000 is tax deductible in the year paid, unless the homeowner’s income is greater than the income limitations placed on itemized deductions and they are phased-out or they are subject to the Alternative Minimum Tax (AMT).

My main concern is that using your mortgage to pay off your credit card debt will simply allow you to get right back into debt again and that is a very real possibility. If you don’t change circumstances and behavior that got you into debt in the first place you will likely find yourself deeper in debt.

The sooner you can get out of credit card debt and stop paying non-preferred interest the sooner you can begin putting your hard earned money to work for you funding the priorities that are important to you.

We have many common and uncommon strategies for getting rid of consumer debt. If you would like our help improving your financial health call us to schedule a time to discuss your specific situation.

Leave a Comment