As a California homeowner, you are responsible for paying property taxes on each and every property you own, but only during the time that you own each property. The amount of your property taxes, as set forth in Proposition 13, is based on the assessed value of each property. For homeowners who purchased property prior to 1978, the assessed value was rolled back to the assessed value of that property in the 1975-76 tax year. For those who purchased a property after 1978, the assessed value was set at the price paid for the property at the time of purchase.

Proposition 13 established the base tax rate in California as 1.00% of the assessed value. For example, if the assessed value of your property is $300,000, your property tax is $3,000 ($300,000 x 1.00%). However, if you look closely at your property tax bill you’ll notice that what you pay is typically more than that. That is because also included in your property tax bill are voter approved bonds, fixed charges, and special assessments. Voter approved bonds are typically for schools and other special projects. Fixed charges and special assessments typically cover things like mosquito control, ambulance, and fire service, etc…

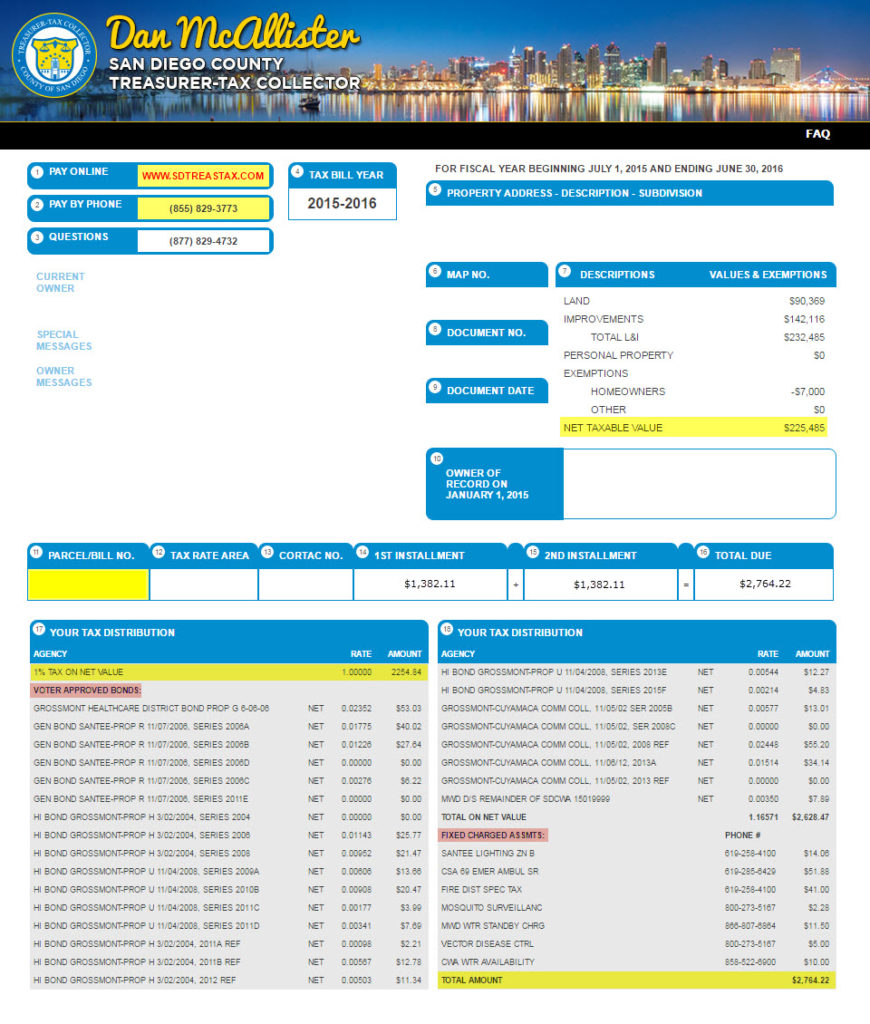

Below is my personal property tax bill. If you look at the highlighted area toward the upper right you’ll see the assessed value, otherwise known as total land & improvements, is $232,485. Because I live in the property as my primary residence I am eligible for a Homeowners’ Exemption of $7,000 per year. This reduces my net taxable value to $225,485 ($232,485 – $7,000), which saves me about $70 per year ($7,000 x 1.00%). About mid-way down the left side you’ll see the 1.00% tax rate and the property tax amount of $2,254.84 ($225,485 x 1.00%). Below that are the approved bonds and on the right side are fixed charges and special assessments. At the bottom right corner you’ll see the total property tax amount is $2,764.22.

That means that I pay $509.38 ($2,764.22 – $2,254.84) annually for these “other” items. My property tax rate is 1.00%, however, as a result of the “other” items on my property tax bill my effective tax rate is 1.189% ($2,764.22 ÷ $232,485)x100).

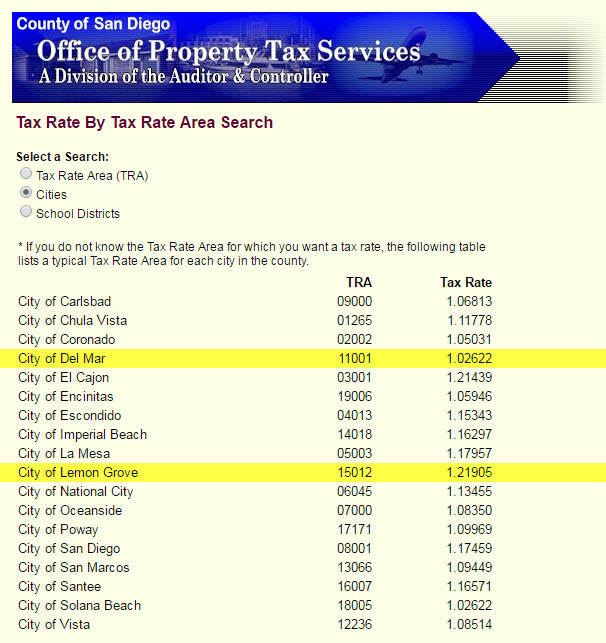

The amounts attributed to voter approved bonds, fixed charges, and special assessments can vary depending on the tax rate area you find yourself in and can make a big difference in the total amount of property taxes you are responsible for. In the Tax Rate Area chart below you can see a low of 1.02622% and a high of 1.21905%.

There are other Special Taxes that may affect your property tax bill, such as Mello-Roos. If you live in an area that assesses Mello-Roos taxes, your property tax bill will include those taxes as well. Even though Mello-Roos taxes are not based on the assessed value of the property, the dollar amount of Mello-Roos taxes can be equivalent to a low of 0.25% to over 1.00% of a property’s assessed value.

There are other Special Taxes that may affect your property tax bill, such as Mello-Roos. If you live in an area that assesses Mello-Roos taxes, your property tax bill will include those taxes as well. Even though Mello-Roos taxes are not based on the assessed value of the property, the dollar amount of Mello-Roos taxes can be equivalent to a low of 0.25% to over 1.00% of a property’s assessed value.

While it’s true that the base property tax rate in California is 1.00%, real estate is inflationary and as a result property taxes will increase over time. The assessed value of a property can increase annually based on the Consumer Price Index (CPI), but by no more than 2% per year unless a re-assessable event occurs. The most common re-assessable events are the completion of new construction, a change in ownership, or a material improvement to the property. Mello-Roos taxes can also increase annually, but possess a similar limit on the annual increase.

This information should serve as evidence that there is almost always more to the story than what we see on the surface and it pays to dig a little deeper.

Leave a Comment