Odds are if you don’t pay them you don’t know what they are and if you do pay them you don’t know why. Mello-Roos is a “Special Tax” paid by homeowners who purchase a home in a “Community Facilities District” and is paid in addition to the County property taxes. When Proposition 13 passed in California in 1978, local government’s ability to increase property taxes and/or impose new taxes was severely limited by the requirement that any proposed increase had to be approved by two-thirds of the voters.

Odds are if you don’t pay them you don’t know what they are and if you do pay them you don’t know why. Mello-Roos is a “Special Tax” paid by homeowners who purchase a home in a “Community Facilities District” and is paid in addition to the County property taxes. When Proposition 13 passed in California in 1978, local government’s ability to increase property taxes and/or impose new taxes was severely limited by the requirement that any proposed increase had to be approved by two-thirds of the voters.

Realizing that the likelihood of getting two-thirds of California voters to agree to increase property taxes was slim and none, two California legislators, Henry Mello and Mike Roos, set out to find a way to raise tax revenue in spite of the overwhelming popularity of Proposition 13, and they found a way.

The Mello-Roos Community Facilities Act of 1982 was created to allow local government agencies to establish Mello-Roos Community Facilities Districts (CFDs), which can issue municipal bonds to raise the money to pay for needed services and improvements, as well as levy taxes on the residents of CFDs to repay the bonds. CFDs are normally formed in undeveloped areas.

Mello-Roos taxes can pay for both services and facilities such as police protection, fire protection, ambulance and paramedic services, parks and recreation facilities, libraries, elementary and secondary school sites and structures, child care facilities, streets and sewer systems, natural gas pipelines, telephone lines, cable television lines, etc… Mello-Roos taxes can be significant depending on the total cost of the services and facilities and the number of residents in the CFD that the cost will be shared by.

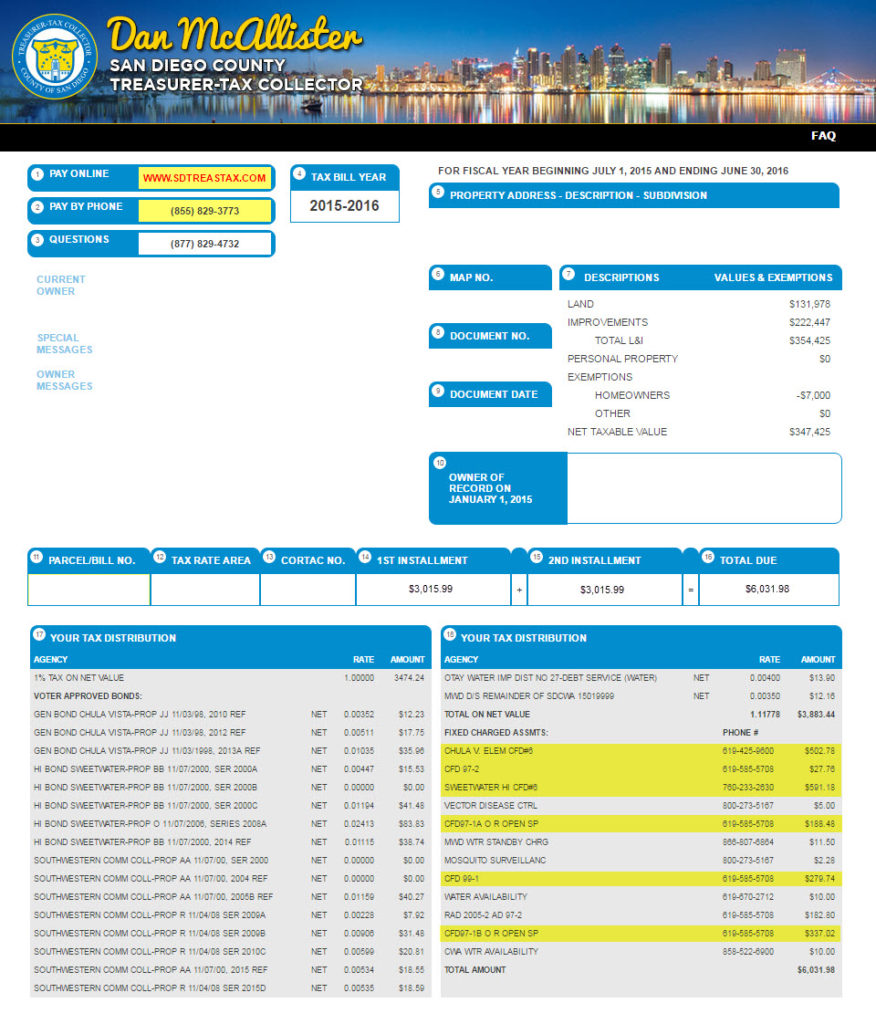

Below is a property tax bill showing a sample of Mello-Roos taxes. The Mello-Roos taxes are identified with a CFD and account for $1,926.96 of the $6,031.98 property tax bill, which is equivalent to 0.544% (($1,926.96 ÷ $354,425) x 100) of the assessed value of the property (Total L&I). That is an effective property tax rate of 1.702% (($6,031.98 ÷ $354,425) x 100).

The good news is that a CFD cannot be formed without a two-thirds majority vote of residents living within the proposed boundaries. The bad news is if there are fewer than 12 residents, the vote is instead conducted of current landowners, and in many cases that may be a single owner, which is typically a real estate developer.

Mello-Roos taxes could be considered a voluntary tax because only people who own property in a CFD are obligated pay Mello-Roos taxes, and only for the specific CFD the property is located in. County property taxes are mandatory and are levied on ALL homeowners. But then again, County property taxes could be considered voluntary because only property owners are obligated to pay them. The difference is that if you want to own property, at least you can choose whether or not to buy a property in a CFD.

Proposition 13 specifies that a Special Tax cannot be directly based on the assessed value of the property. Instead, they are based on mathematical formulas that take into account the use of the property, square footage of construction, and size of the lot. The formulas are defined at the time of formation of the CFD and will include a limit for annual increases as well as a maximum amount for the special tax.

Due to the method of calculation, like County property taxes, Mello-Roos tax amounts can vary from homeowner to homeowner within a CFD. However, because Mello-Roos are not based on the value of the property, the amount of Mello-Roos is not re-assessed due to a change in ownership.

Unlike County property taxes, Mello-Roos tax will eventually expire (within 40 years of the establishment of the CFD) because the bonds have been repaid. However, a CFD may continue to charge a reduced fee to maintain the improvements.

It is important to note that a CFD has the right to foreclose on property when special taxes are delinquent more than 90 days, whereas County property taxes can be delinquent up to 5 years before foreclosure proceedings can begin. This is not likely to be a problem because, with rare exception, Mello-Roos taxes are itemized on a homeowner’s annual property tax bill and due and payable on the same dates. To determine which taxes are Mello-Roos look for those identified by the CFD label.

There is some confusion and disagreement regarding the tax deductibility of Mello-Roos taxes. While County property taxes are deductible on your income taxes if you itemize your deductions, Mello-Roos taxes are typically not deductible on your income taxes.

I do not offer tax or legal advice. Consult your attorney or tax advisor as to the applicability of this information to your specific circumstances and for complete up-to-date information concerning federal and state laws in this area.

Leave a Comment